The unstoppable growth of streaming services

Could Disney+ really overtake Netflix? If its recent success is anything to go by, then that is a distinct possibility, according to the new Global Digital Subscription Snapshot 2021 Q1. As the first wave of the pandemic hit last year, Disney+ entered a streaming landscape largely carved out by its predecessor, beaming hours of entertainment into millions of locked-down homes. Within 12 months, it had already achieved its 90 million four-year subscriber target. So what does this tell us about the state of streaming right now?

The year of video streaming

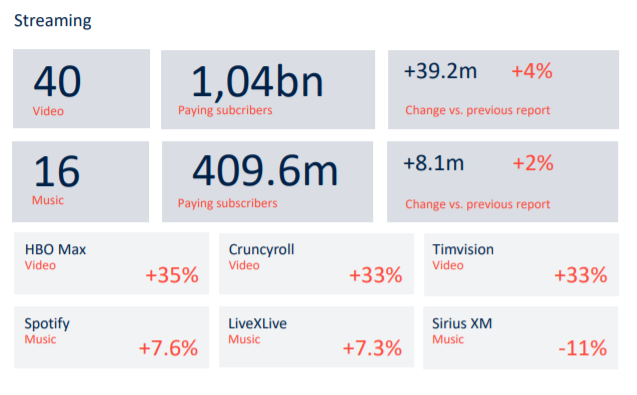

First things first, it’s part of a wider trend that has seen a good year all round for streaming. The year 2020 set a record for new streaming subscriptions, with an increase of 217.6 million in Q3 2020 in comparison to the same period the previous year.

High subscription growth rates across the board, outlined in the report, are firm evidence of the wider digital subscriptions boom now underway, with streaming being one of the most prominent examples. And with many lockdowns still in place around the world, that may be set to continue for a while.

Pandemic surge for Disney+ and Netflix

Driven in no small part by the pandemic, Disney+’s current figure represents a noticeable jump from the 86 million subscribers it reported in Q4 2020. That puts it ahead of Netflix in both percentage increase and numbers of new subscribers added.

Nonetheless, Netflix’s numbers are nothing to sniff at. In January 2021, the company announced that it had reached the key milestone of passing the 200 million subscriber mark. Despite the stiff competition, paid membership throughout 2020 increased by 37 million, and its strategy of aggressive investment in original content for its platform seems to have paid off, with shows The Queen’s Gambit and Bridgerton attracting record-breaking household viewing figures.

New kids on the box

The video streaming market is seeing a boom in new services. Apple TV+ and NBCUniversal’s Peacock both launched in 2020 at the height of the pandemic, with HBO Max also announcing new international expansion goals and CBS rebranding its service to Paramount+.

Sports streaming service DAZN also scaled up significantly, launching into more than 200 new countries and territories by the end of 2020.

With so much on offer, FIPP CEO James Hewes reckons consolidation might be inevitable. After all, there are only so many hours in the day, and as vaccine rollouts pick up pace, we might see people easing into a “new normal” that doesn’t include so much TV.

Spotify subscriptions are up, too

Spotify now boasts 155 million paying subscribers and expects to increase this number further to 184 million by the end of 2021.

The company credits the surge in new subscribers to its service to its strategic expansion into podcasts, with founder Daniel Ek recently telling the Guardian that podcast listening hours have more than doubled in 2020 as the pandemic drove people to seek out new forms of entertainment, information, and companionship.

Amazon has been watching Spotify’s success closely, recently closing its US$300 million acquisition of podcast company Wondery in order to expand its library of content.

Click here to become a FIPP member and access the full Global Digital Subscription Snapshot 2021 Q1. In addition to more streaming insight, you’ll find in-depth analysis, key stats and much more on the media landscape’s current subscription boom.