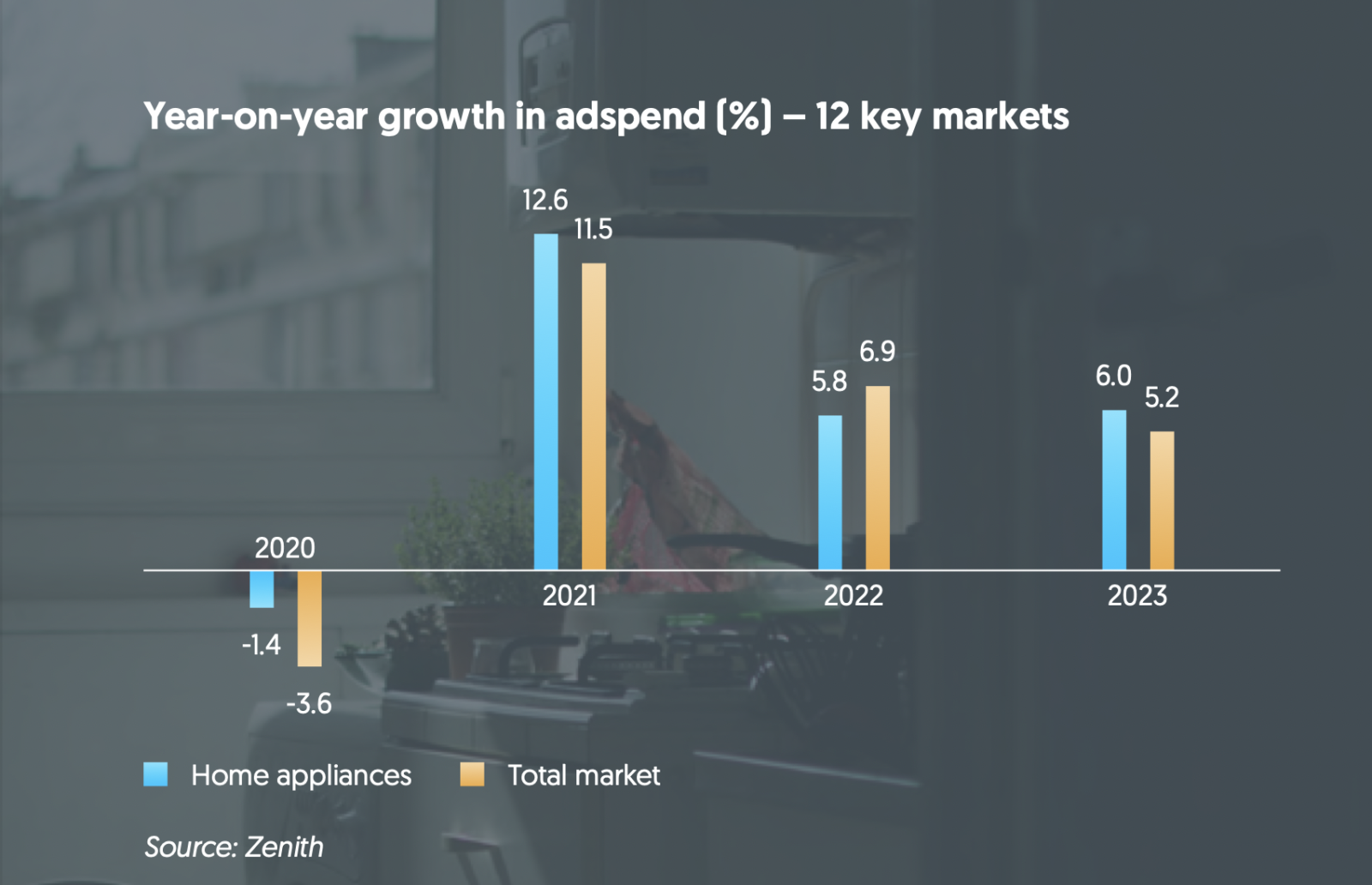

Zenith forecasts significant growth in home appliance advertising through 2021 and beyond

In a new report released this week, Zenith forecasts that home appliance advertising will grow by 12.6% in 2021, ahead of the wider advertising curve of 11.5% growth. The study analyses trends across twelve markets, including Australia, Canada, China, France, Germany, India, Italy, Russia, Spain, Switzerland, the UK and the US, which between them account for 74% of total global ad-spend. India and Russia are predicted to lead annual expansion in the sector, with 18% and 16% growth respectively.

Forced to spend more time at home, consumers are investing in making their homes more pleasant to live in, using some of the money freed up by being unable to socialise or go on holiday. This is fuelling rapid growth in demand for both large and small appliances: particularly cookers, washing machines, dishwashers and air conditioning units.

Despite the easing of coronavirus restrictions, Zenith expects consumers will continue to devote more of their time and budgets to the home than they did before the pandemic, and forecasts 6% annual growth in home appliance ad-spend in 2022 and 2023.

The company says that advertising expenditure by home-appliance brands will rise from US$4.4bn in 2020 to $5.0bn in 2021, well ahead of the $4.5bn spent before the pandemic in 2019. By 2023 ad-spend will reach $5.6bn.

“In most markets, the increased appetite for home improvement is incentivising home-appliance brands to step up their communications activities substantially,” said Jonathan Barnard, Head of Forecasting, Zenith. “Most of this growth is going to digital channels to support increased e-commerce activity, but traditional media like television and out-of-home will remain essential tools for maintaining mass brand awareness.”

Brand building and e-commerce to drive 10% annual growth in digital advertising

Digital advertising accounted for 55% of home-appliance ad-spend in 2020, up from 51% in 2019. It is essential both for brand building – mainly using online video, native advertising and social media – and performance, using paid search.

Most purchases of large home appliances are distressed, i.e. made out of urgent necessity, to replace a broken appliance. The company says that with few distinguishing features between physical appliances, brand advertising is essential for creating differentiation and placing the brand at the top of mind when the consumer realises they need to buy. Paid search is then used for conversion during the short window of opportunity when the consumer is researching replacement options.

Digital advertising will become even more important to home-appliance brands over the next few years as they continue to embrace e-commerce. Home-appliance brands were already well ahead of the market in adopting ecommerce before 2020, but the pandemic led to a step-change in home-appliance ecommerce.

“Faced with rising interest in purchase, the increased role of digital in the mid-to-lower funnel, and a greater focus on delivering direct-to-consumer experiences, appliance brands have never operated in a more demanding and complex marketplace,” said Drew Erskine, Global Strategy Lead, Zenith. “Successfully building brands for the long term will require agile strategies that find the balance between cultivating desire through broad communications and converting interest, often digitally, in more relevant ways.”

You can download the report in full on the Zenith website here.