Game advertising: it’s time to play

There are many reasons why digital games are an ideal channel for advertising. They reach an audience that is more engaged and receptive than most other media channels, and they eliminate some of the issues that complicate other forms of digital advertising, like viewability and banner blindness. Advertisers who take the time to understand the power of game advertising, are likely to find they can be winners in this ad game.

PwC analysts forecast game advertising to be the fastest growing (but still smallest) segment of games revenue, growing from $2.84bn in 2014 to $4.75bn by 2019. Globally, the US, the UK, China, and Japan are the largest markets for game advertising, thanks to their advanced ad ecosystems and large potential audiences. There’s ample data to corroborate the effectiveness of the games channel. MediaBrix found social and mobile gaming videos have an average click-through rate (CTR) 30 times higher than those for standard banner ads.

Who’s playing now

Games both reflect and shape some of the major trends in Internet usage. As the Internet becomes increasingly central in facilitating social connections, more and more people want to play games with new or existing friends. Meanwhile, mobile phones make a great platform for gaming and have been a driving factor for drawing additional consumers to online games. In fact, eMarketer forecasts that by next year, 80 per cent of smartphone users will use the device to play games. These shifts are changing the business models for video games and changing the demographics of who’s a gamer.

There was a time when the term ‘video gamer’ would primarily conjure images of teenage boys playing shooter games. But anyone who’s paying attention to trends in online games knows that’s an outdated stereotype. According to a recent US study by the Entertainment Software Association (ESA), Essential Facts About the Computer and Video Game Industry, ‘Women age 18 or older represent a significantly greater portion of the game-playing population (33 per cent) than boys age 18 or younger (15 per cent).’ And the Internet Advertising Bureau (IAB) found that in the UK, 52 per cent of gamers are female.

According to the IAB’s Games Advertising Ecosystem Guide, free-to-play or ‘freemium’ games are redefining how games publishers approach monetisation. There has been a shift away from games that are purchased or played by subscription toward games that are either partially or entirely free. Subsidising games with advertising offers games publishers an attractive channel for monetising; it offers brands new venues for reaching engaged consumers; and it offers gamers a way to enjoy more games…a win, win, win.

Type of game advertising

There are three general categories of game advertising:

|

Around game ads – deliver ads outside the actual game play experience. This could be a sponsorship in the form of a display or video ad that’s shown in between levels or while the game is loading. These can be standard IAB ad units or something more customised for the particular game. |

|

|

In-game ads – present ads that are integrated into the game play environment, for example, a brand logo appearing on a billboard or building in a 3D environment (such as the Wendy’s ad seen in the Shaun White Skateboarding game). While around game ads are typically seen for just a few seconds, in-game ads have the potential to be viewable for extended periods of time, as the gamer navigates within the virtual world. In some cases the products are tightly integrated into the actual story line of a game, just as major brands are integrated into TV shows and movies. For example, ESPN’s logo can sometimes be seen in the arenas of sports-themed games. |

|

Initially all in-game ads were static, i.e., permanently hard-coded into games. As advertising technology has evolved, dynamically inserted ads have become commonplace. The dynamic ads appear in pre-set inventory locations, just as they would on a website. This allows ad servers to deliver ads on short lead times and target ads by time, location, etc.

In addition to integrated static and dynamic ads, there’s another growing type of in-game promotion know as ‘value exchange’. Brands reward players with in-game currency or additional levels to augment or extend game play. In exchange, players agree to interact with the brand, such as watch a video, participate in a survey, download a coupon, etc.

|

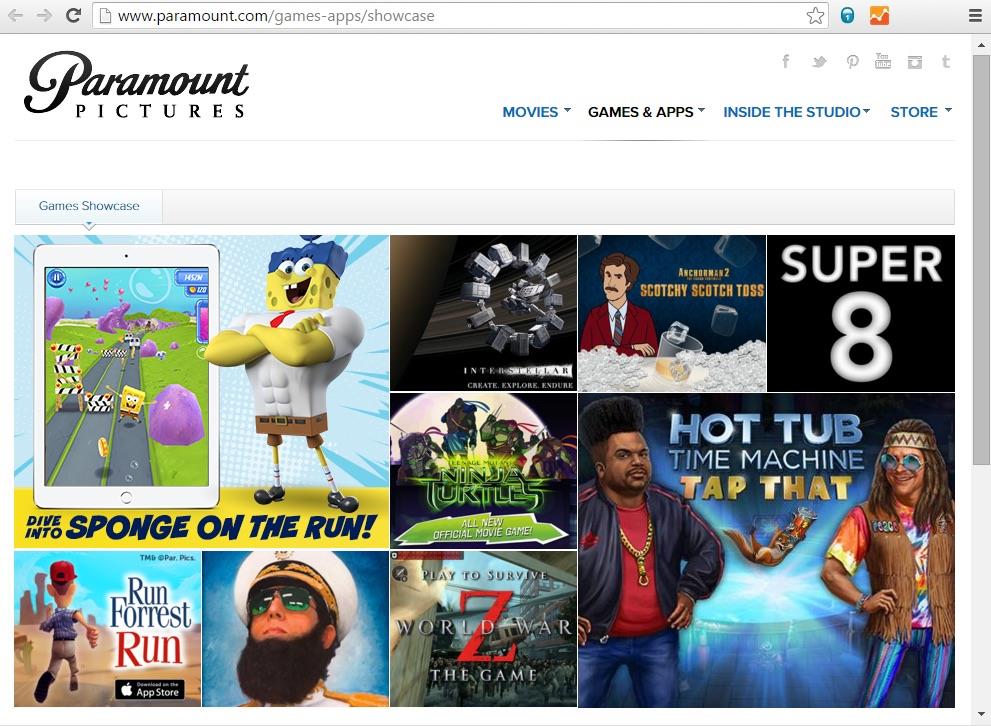

Custom branded games – also known as ‘advergames’, are designed to promote a specific brand or product. Movie studios often use advergames to generate visibility for big film releases, and not just action films. The Paramount Pictures Games Showcase features games designed to promote movies across a range of genres, including comedy (Anchorman 2), drama (Forrest Gump), horror (Super 8), and sci-fi (World War Z). In fact, advergames are used to build awareness and engagement by a wide range of consumer brands, whether targeted to kids, like the McDonald’s Happy Meal games; adults, like the Mercedes-AMG Ice Luge game; or a players of all ages, like the KFC’s ColonelQuest game. |

|

Opportunity and measurement

The metrics used to measure game ad performance will be largely familiar to media buyers who deal with campaigns in other digital channels. Cost per thousand (CPM), cost per view (CPV), cost per acquisition (CPA), and Programmatic are all found in games advertising. However, a term that may not be familiar is cost per integration, which refers to the fixed cost of a custom game or value exchange.

For advertisers and publishers ready to play in the world of game ads, there are several decisions that need to be made. First, determine the ad format that is right for your brand and your audience. Second, identify the type of ad network that fits your needs. Some ad networks cross media channels while other networks are specific to games, such as CPMStar, Ad4Game, and PlayWire Media. Third, choose technologies that are best suited for targeting and optimisation.

Two companies trying to bring big data insights to game advertising are Woobi and deltaDNA. These vendors offer ad-serving platforms that use real-time player monitoring to target ads, in-app purchase offers, or value exchange promotions in order to maximise revenue and player engagement. For some free insights on what type of games monetise best, check out deltaDNA’s new study on free-to-play (F2P) mobile in-game advertising.

Although game advertising is growing on computers and console platforms (e.g., Xbox), monetising mobile usage is an area where games are really able to shine. Mobile ad revenue growth has lagged the shift in web traffic from desktop to mobile internet access, for both technological and viewer engagement reasons. But in the next year, watch for games to be a significant catalyst for growth in mobile ad revenue. And as the New York State ‘Lotto’ lottery slogan says, ‘you gotta be in it to win it.’

More like this

Time to bring sexy back to the publisher + advertiser marriage

News UK study demonstrates how exposure to advertising provokes conversation