McKinsey report predicts media restructuring addressing change in spend patterns

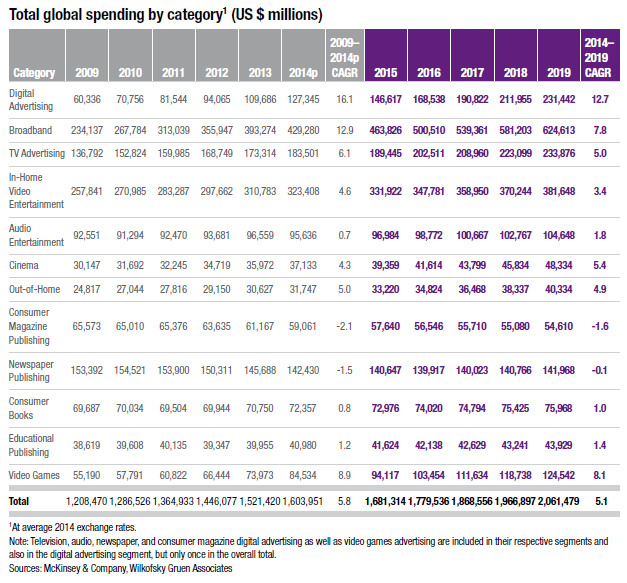

Spending on media continues to shift from traditional to digital products and services at a rapid pace. By 2019, McKinsey & Company believes digital spending will account for more than 50 per cent of overall media spend. Within this, digital video spending will overtake physical spending by 2018, two years earlier than it had previously forecast.

Digital, consisting of internet and mobile advertising, will become the largest advertising category by 2017, surpassing TV one year earlier than forecast, and mobile will more than double its share of the digital ad market.

The reports says that this rapid digital shift is being driven in part by the growing number of connected consumers, the expansion of mobile telephony, and elevated mobile broadband adoption. As it continues, it will not only expand the digital share of the media wallet, but have a structural effect on almost all media sub-sectors, redefining business models.

As the number of direct-to-consumer services increases and the number of smart devices grows, the ability of consumers to self-serve the entertainment they desire will increase as well.

Another important change McKinsey identified is the rise of global content intermediation and integration, as leading social-networking platforms, both personal and professional, provide videos, music, and news from outside sources directly to their users. They hope that aggregating and integrating additional content will boost their consumer interactions and change consumption patterns. These steps could mark a major shift for a sector that inherently struggles with monetisation.

A third key change finds that as digital media gain ground, advertisers are increasingly accepting the validity and persuasiveness of advertising on these media, moving away from the typically high cost-per-thousand (CPM) traditional media to less expensive, low-CPM Internet and mobile advertising – further accelerating the shift of analog dollars to digital.

Despite its emphasis on the shift to digital as a primary theme, however, McKinsey states that traditional media remain a considerable factor. While analysts and advertisers increasingly focus on digital entertainment, traditional TV still dominates, bringing in a projected 38.7 per cent of advertising spend worldwide in 2014, the largest advertising share. In addition, while traditional media segments are flat or declining in developed markets, many are still sizeable sectors in emerging regions, with a healthy outlook.

The McKinsey report concludes: “As a consequence of this accelerating pace of change, it is not surprising that long-term beliefs about the sources of value in a given business model, media segment, or country are also updating rapidly, creating tremendous uncertainty. Equity prices are far more volatile and unpredictable, as it is far harder for media companies to place bets – even in their core businesses and markets – and feel confident they understand who the ultimate winners and losers will be. Reflecting this uncertainty, we would not be surprised to see a number of global media organisations reshuffle their corporate structures over the coming months in an effort to create clarity for their investors – and perhaps their management – around the roles of the different types of media businesses in their portfolios.”

“We hope that our Global Media Report 2015 will also provide some clarity, even as we admit that more changes are coming – many as yet unimagined.”

Download the 2015 McKinsey Global Media & Entertainment Forecast

More like this

People spend eight hours a day consuming media, reports ZenithOptimedia

Latest GroupM report confirms digital is no longer a separate channel

US report reveals social media growth for magazine media brands