Why you should pay attention to the London start-up scene

Let’s start with the UK. Last year more then 500,000 new companies were created. A large proportion were in the ‘capital efficient’ tech/media/telecoms space, benefitting from both reduced launch costs – a function of legislation (50 per cent tax breaks on seed capital), ever cheaper technology, the attractiveness of the UK to an international talent pool, along with a new found desire from corporates to access start-up innovation, to partner with/buy from/invest in game-changing start-ups. Additionally there is something else, the kudos of becoming an entrepreneur, with an opportunity to change the world, to build something disruptive, to create wealth and jobs. This has been championed for five years in the UK from the Prime Minister down to school curriculums.

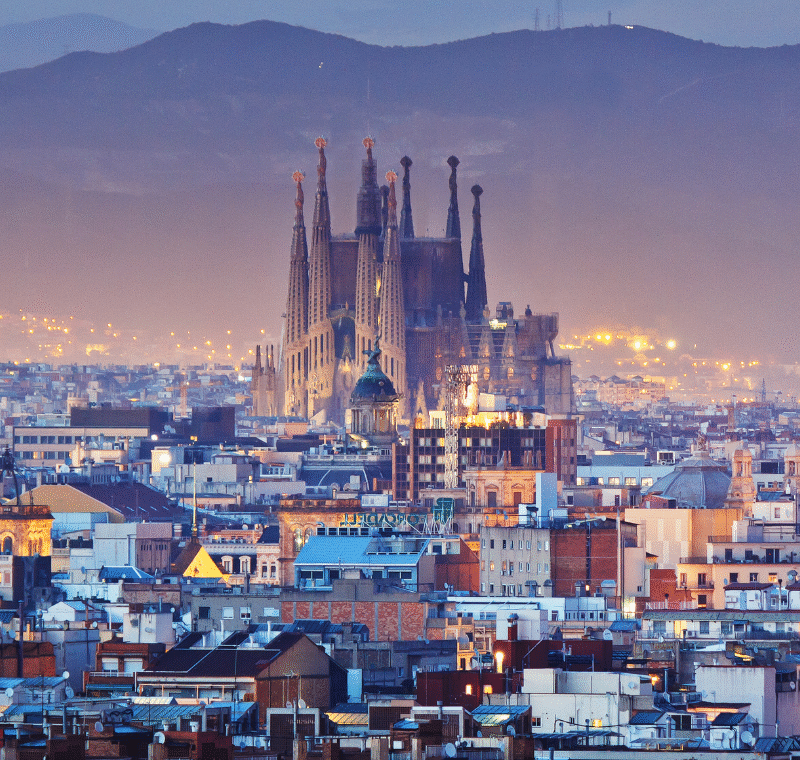

The epicentre of this activity is London, a city of eight million people, with a booming entrepreneurial culture and support network. A connected ecosystem has sprung-up to serve the broad needs of this nascent industry. Accelerators, incubators and co-working spaces, angel syndicates, tax-driven seed funds, early stage Venture Capitalists (VCs), and an army of support and service providers focussed on start-ups, from lobbyists to lawyers, accountants to innovation agencies, helping to join up the dots, and create a world class start-up hub.

Is any of it working? I’d like to think so – London’s digital technology sector is forecast to boost the British economy by £12bn and create 46,000 jobs over the next decade.

What is the impact of this? Is it an opportunity or threat to FIPP members? The world is changing and disruptive start-ups are hungry for new markets, aggressively targeting the attention of digitally native audiences to new media/content/devices/distribution channels, changing adspend behaviour from direct clients and agencies, leveraging citizen journalism / UGC, moving publishing into a new era. The opportunity to learn from them, partner with them, invest in them is immediate, and we want to show you how.

We have the right funding landscape to promote growth. Video ad technology company Unruly Media was founded in 2006, and has delivered a number of high profile social video campaigns for global brands, including industry classics like The T-Mobile Dance, Evian Roller Babies and Old Spice’s The Man Your Man Could Smell Like campaign as well as more recent initiatives like the Coca-Cola Where Will Happiness Strike Next series.

In early 2012, Unruly Media announced a US$25m Series A investment from Amadeus Capital Partners, Van den Ende & Deitmers, and the government’s Business Growth Fund, helping it expand internationally. By 2014, Unruly was generating more than $43m, seeing growth of 40 per cent from Q4 2013 to Q4 2014.

We also have clients, brands and agencies willing to work with start-ups. Digital publishing start-up Better Than Paper, has experienced this first hand. Founded in 2011 by Ashwin Saddul, Better Than Paper went through our Accelerator Academy, and has since gone on to work with many household brands including Hiscox, Virgin Media, Barclays, EurotaxGlass’s Group and RBS. It recently announced a long-term collaboration with global insurer, RSA. This partnership will see Better Than Paper develop the RSA News App – an internal global social magazine for the company’s employees.

Better Than Paper uses innovative software to create bespoke digital magazines by pulling data and content from across the web, quickly and efficiently producing digital magazines. The News App will be used by RSA to share insurance news. It will also be integrated into the company’s Microsoft’s Yammer platform.

Ashwin Saddul, managing director of Better Than Paper, said of the collaboration: “It’s clear that the digital publishing industry is one that is ready for disruption. We’re looking forward to continuing to develop our product and working with more global businesses like RSA.”

A certain something is happening right now. And it’s happening here in London.

Be a part of FIPP’s London Start-up Tour

FIPP is offering the opportunity to observe, in close proximity, the London media and digital scene and be introduced to thought leadership around collaborating with start-up companies, meeting the leading lights in the space, across a variety of start-up stages: established, emerging and future, alongside a senior peer group of innovative international publishers.

FIPP and The Accelerator Network are currently finalising the dates for the Tour, which is likely to take place in mid-November 2015. To register your interest contact Christine Huntingford.

About Ian Merricks

For nearly four years, since selling my contract and retail publishing business, I have been actively engaged in this exact space, participating in every one of the above activities, having launched the Accelerator Academy, supported by London Mayor Boris Johnson from launch (a shrewd move by him, we’ve now supported 100+ tech and media start-ups, most from pre-revenue stage, to the point they are now approaching £200m of post money valuations), we supported the development of the Innovation Warehouse (16,000 square foot in Central London, hosting 70 companies at any one time) and The Hangout, a City University London space in sight of the ‘Silicon Roundabout’ at Old Street.

I’ve had the opportunity to invest in these start-ups at the seed stage, benefitting from the tax breaks. I’ve taken a stake and board role in a seed fund (Start-up Funding Club) with more than £3m invested to date, and worked with the early stage VCs and others in the funding space to secure nearly £20m of seed funding into the start-ups I meet.

Recognising the support of corporates and service providers, I’ve developed partnerships with big brands (Visa, Virgin, Natwest, Crowdcube, Dell, IBM) and law firms (Nabarro, Marriott Harrison, Pitmans), accountants (haysmacintyre, FreeAgent), influenced policy through responses to consultations with HM Treasury, The CityUK, Start-up Britain and The Entrepreneur’s Network [Westminster think tank] where I’m proud to be an Ambassador.

Two years ago, the UK Trade and Industry (UKTI) backed our accelerator programme, securing hard-fought places on behalf of international start-ups relocating to the UK, enabling them with grant assistance, Home Office visas, and access to markets. Over the last year the EU (European Regional Development Fund) agreed to match fund a new pre-accelerator we co-founded, to unite 30+ of the UK’s best accelerators, incubators, grant/debt/seed equity providers, with the support of the chartered institutes (across disciplines including tech, finance and marketing). As a result of this activity I became chair of The Accelerator Network in April this year, and I am delighted to work with the Government’s business department (BIS) on strategies to support a growing number of high potential start-ups each year, and increasingly working with UK regions and overseas corporates and governments to share learning, of how to replicate Tech City London outside of the capital. The word is spreading, but it began here in London.