Zenith adspend forecasts reveal unprecedented stability of the global ad market

Zenith has been monitoring global advertising expenditure and forecasting its short-term growth for nearly thirty years, and we have a database that goes back to 1980. The current stability of the advertising market is unprecedented over this period.

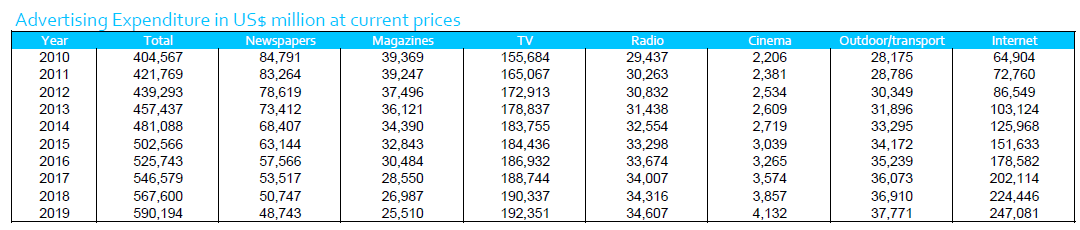

Ever since 2010, the global advertising market has grown by four per cent to five per cent a year, and we expect it to continue to do so at least to 2019. Normally the ad market exaggerates the wider economy, growing more rapidly in an upturn as advertisers enter more markets and launch new brands, and contracting more rapidly in a downturn as advertisers do the opposite, cutting marketing costs to preserve their bottom line. Since 2010, though, advertising expenditure has grown at or slightly behind the growth rate of the wider economy.

We see this as a persistent effect of the financial crisis of 2007, which has reduced companies’ appetite for risk, making them more likely to hoard their cash or return it to shareholders, and less likely to invest in expansion. This means that the ad market is not growing as rapidly as we would expect at this point in the economic cycle; we will have to wait to see whether it also means there is less ‘excessive’ advertising to cut during the next downturn.

Asia Pacific is leading the growth in global advertising expenditure. We forecast that 43 per cent of the new ad dollars added to the market between 2016 and 2019 will come from Asia Pacific. China is the biggest single contributor to growth, due to its scale – it’s the second biggest ad market in the world, worth US$75 billion in 2016. But India, Indonesia and the Philippines are big contributors too, each of substantial size (between US$3 billion and US$8 billion in 2016) and growing at double-digit rates. By 2019 Asia Pacific will account for 33.4 per cent of global advertising expenditure, up from 32.1 per cent in 2016. This will be the first time it will account for more than a third of the global total.

North America and Western Europe are relatively slow-growing regions, forecast to grow at three per cent a year to 2019, compared to Asia Pacific’s five per cent. But they are large enough that we expect them to contribute 29 per cent and 11 per cent respectively of global advertising growth to 2019.

Central and Eastern Europe is gathering speed after conflict and sanctions hit Russia and connected markets in 2015, following a sharp drop in oil earnings. Latin America is beginning to recover from very tough economic conditions. Argentina’s recession looks like it came to an end in late 2016, while this year Brazil has emerged from its longest recession since the 1930’s. These are small advertising regions, though, and we expect Central and Eastern Europe to account for only six per cent of global advertising growth to 2019, while Latin America accounts for four per cent.

The drop in oil prices since 2014 has had a severe effect on the economies in the Middle East and North Africa, and has prompted advertisers to cut back their budgets in anticipation of lower consumer demand. Political turmoil and conflict have worsened, further shaking advertisers’ confidence in the region. Advertising expenditure has been shrinking here since 2015, and we expect it to continue to do so through to 2019, at an average rate of nine per cent a year.

Looking at global advertising by medium, most growth is coming from the internet, specifically mobile advertising. Mobile advertising has grown from less than US$1 billion in 2010 to US$79 billion in 2016, as mobile devices have proliferated, displays have grown larger and more detailed, and connection speeds have improved. Mobile ads have got better too, moving away from intrusive pop-ups that make it impossible for viewers to see what they’re actually interested in, towards native-looking in-feed ads and skippable video ads.

Mobile advertising is still the principal driving force of advertising growth: we expect it to grow by US$76 billion between 2016 and 2019, ahead of the US$69 billion net increase in total advertising expenditure over this period. Mobile growth will be counterbalanced by an US$8 billion decline in desktop advertising, as consumers continue to switch their online activity to mobile devices, and a US$14 billion decline in print.

Print has suffered the most from the rise of the internet. Before internet advertising got started in the mid-90’s, newspapers and magazines together accounted for 50 per cent of all advertising expenditure; now they account for 15 per cent. Newspapers have suffered more than magazines, because they relied more on classified advertising, which has almost entirely gone to the internet, and because the instant delivery of news over the internet is a clear upgrade of one of their main functions. But magazines advertising expenditure has halved from its peak value of US$60 billion in 2007 to US$30 billion in 2016, and we expect it to fall further to US$23 billion in 2019.

This refers purely to advertising in magazines’ printed editions. Advertising that appears within magazines’ online editions, plus their digital brand extensions and apps, counts as internet advertising. By investing in their online operations, publishers have been able to recoup some of their lost print ad revenues, and seek out new sources of revenue. The modern web gives magazine publishers great scope to exercise their traditional expertise in design and imagery, and to extend them in new directions.

Video is a particularly promising direction for expansion. Online video is one of the fastest-growing types of advertising at the moment, one that we forecast to grow by 16 per cent a year to 2019. Demand from brands is high, and the supply of high-quality content is limited, so investment in online video has the potential for generous returns.

More like this

Zenith: 75 per cent of internet use will be mobile in 2017

Zenith: 26 per cent of media consumption will be mobile in 2019

Zenith report: Underlying growth in global adspend strengthens in 2017