Zenith: Paid search and social to drive 67 per cent of adspend growth by 2020

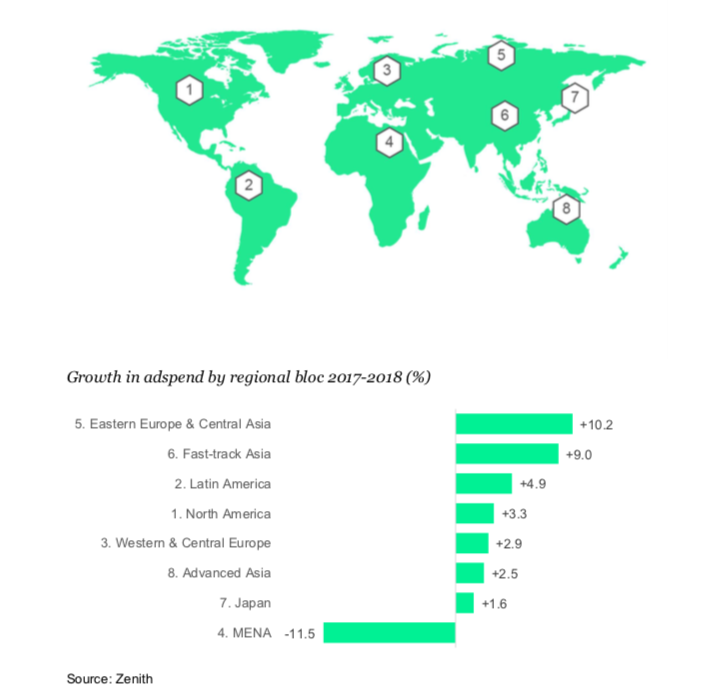

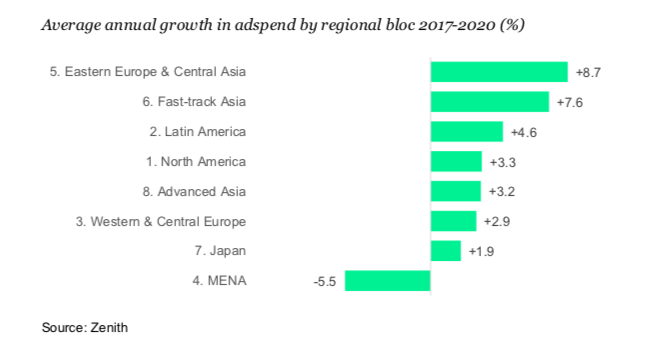

Some markets have strengthened (notably Canada and the UK), but these have been counterbalanced by markets that have weakened, particularly the Middle East and North Africa (MENA). Our forecast for 2019 is also unchanged at 4.2 per cent growth, while we have reduced our forecast for 2020 from 4.3 per cent growth to 4.2 per cent. Growth will therefore remain within the four to five per cent range it has maintained since 2011.

Economic growth has picked up this year in Canada and the UK, and demand from advertisers has been stronger than expected, so we have revised our forecast for adspend growth in Canada this year from 3.8 per cent to 5.6 per cent, and in the UK from 0.7 per cent to 2.4 per cent. These two revisions alone will add US$581m to the global ad market this year. We have also made substantial upward revisions in Vietnam (US$131m), France (US$121m), and Taiwan (US$104m). Western Europe is the most improved region, revised up from 2.3 per cent growth in 2018 to 2.6 per cent growth.

After conducting new research into true levels of expenditure in MENA, we have thoroughly revised our estimates of historic ad expenditure in the region. Our estimate of regional adspend is now higher than it was previously, but so too is our estimate of the shock the region has suffered from the drop in oil prices since 2014, political turmoil and conflict. We now consider that adspend shrank by 40 per cent between 2014 and 2017, more than our previous estimate of 33 per cent. But we estimate that ad expenditure across MENA totalled US$3.6bn in 2017, ahead of our previous figure of US$2.4bn. We now forecast an average annual decline of 5.5 per cent to 2020, well below our previous forecast of 1.4 per cent average annual decline.

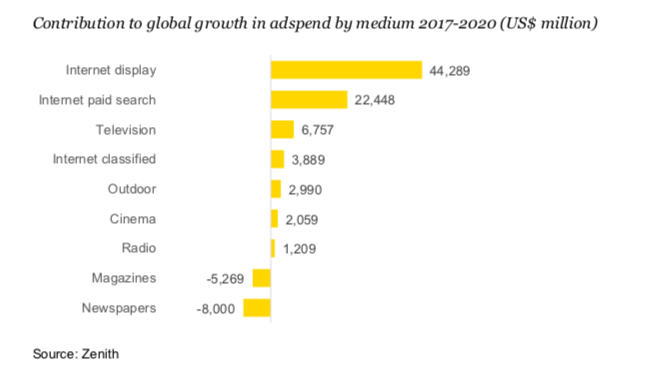

We forecast that two thirds of all the growth in global advertising expenditure between 2017 and 2020 will come from paid search and social media ads. Over this period, total spending will increase from US$86bn to US$109bn on paid search, and from US$48bn to US$76bn on social media. Paid search will grow by US$22bn over this period, while social media will grow by US$28bn, making it the single biggest contributor to growth.

Paid search has undergone constant development in recent years. Search platforms, agencies and brands are applying ever more sophisticated artificial intelligence techniques to improve targeting, messaging and conversion. Search is becoming more integrated with commerce, both online – as brands shift budgets to ecommerce platforms – and offline, as retailers use location and store inventory data to match active shoppers directly with the products they’re searching for. All these developments are attracting higher performance budgets from brands, often new expenditure rather than being diverted from brand awareness activity. Overall we expect them to drive an average of eight per cent annual growth in paid search adspend between 2017 and 2020.

Much of the recent rapid growth in social media advertising has come as platforms have replaced static ads with more engaging video ads. So far these social video ads have acted more as complements to television ads than competitors, but the platforms are now competing with television more directly by hosting long-form content like sport, drama and comedy, and inserting mid-roll ads like those seen in television breaks. Overall we expect social media adspend to grow by an average of 16 per cent a year to 2020, twice the rate of paid search.

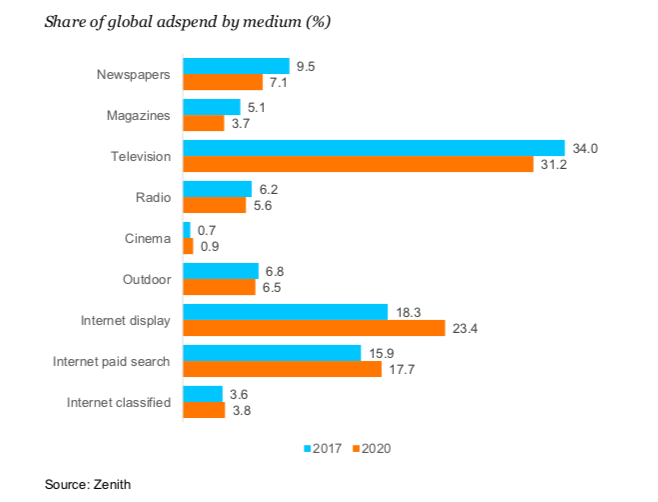

The fastest-growing traditional medium is cinema, which we forecast to grow by 16 per cent a year thanks to rapidly rising admissions in China. It is a tiny medium, though, representing just 0.8 per cent of total adspend this year. Otherwise outdoor is the strongest performer, with 3 per cent annual growth. Outdoor is benefiting from its wide reach and ability to create mass awareness, which allows it to complement highly targeted online advertising for premium brands. While targeted online ads move buyers along the path to purchase, premium brands still need to create widespread awareness among non-buyers – a premium brand will only remain one if everyone recognises its premium value.

More like this

Zenith: Iran leads adspend growth in 30 rising media markets

Zenith: Online advertising will exceed 40 per cent of global adspend this year

Zenith: Luxury brands are now starting to embrace digital advertising

Zenith: World Cup to boost global adspend by US$2.4bn this year

Zenith: Online video viewing to exceed an hour a day in 2018