Worldwide digital ad trends: FB and Google dominate; Snapchat to grow; 3 x Chinese giants the only potential rivals

eMarketer chairman and co-founder Geoff Ramsey was at Digital Innovators’ Summit 2017 on 21 March, where he spoke about “The epic battle for attention in a digital world”, and hosted an advertising panel discussion about “Where ad spend is going, and why?” with three top ad agency execs. Here is our article on his two sessions.

More from eMarketer’s press release earlier this morning:

Facebook and Google

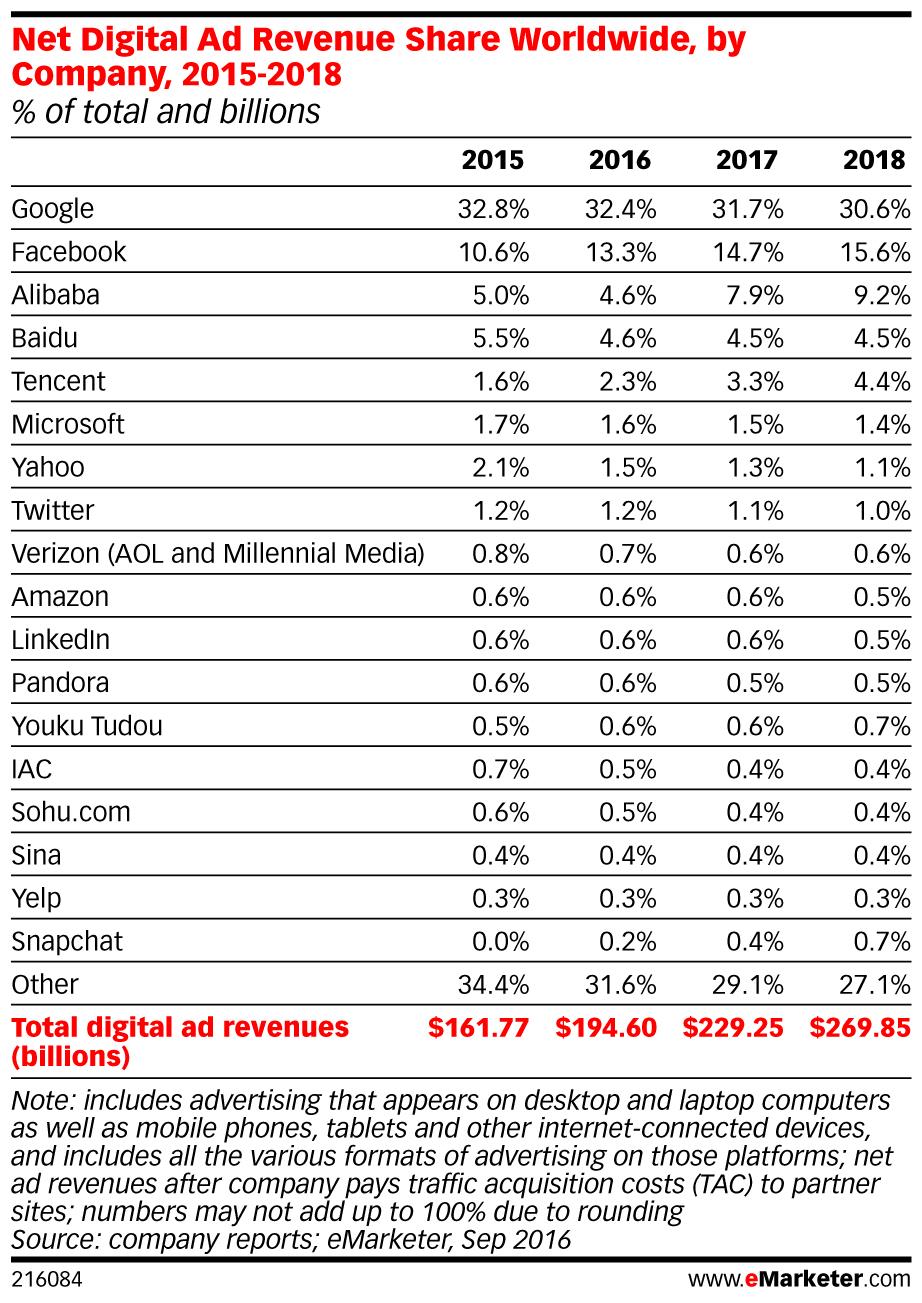

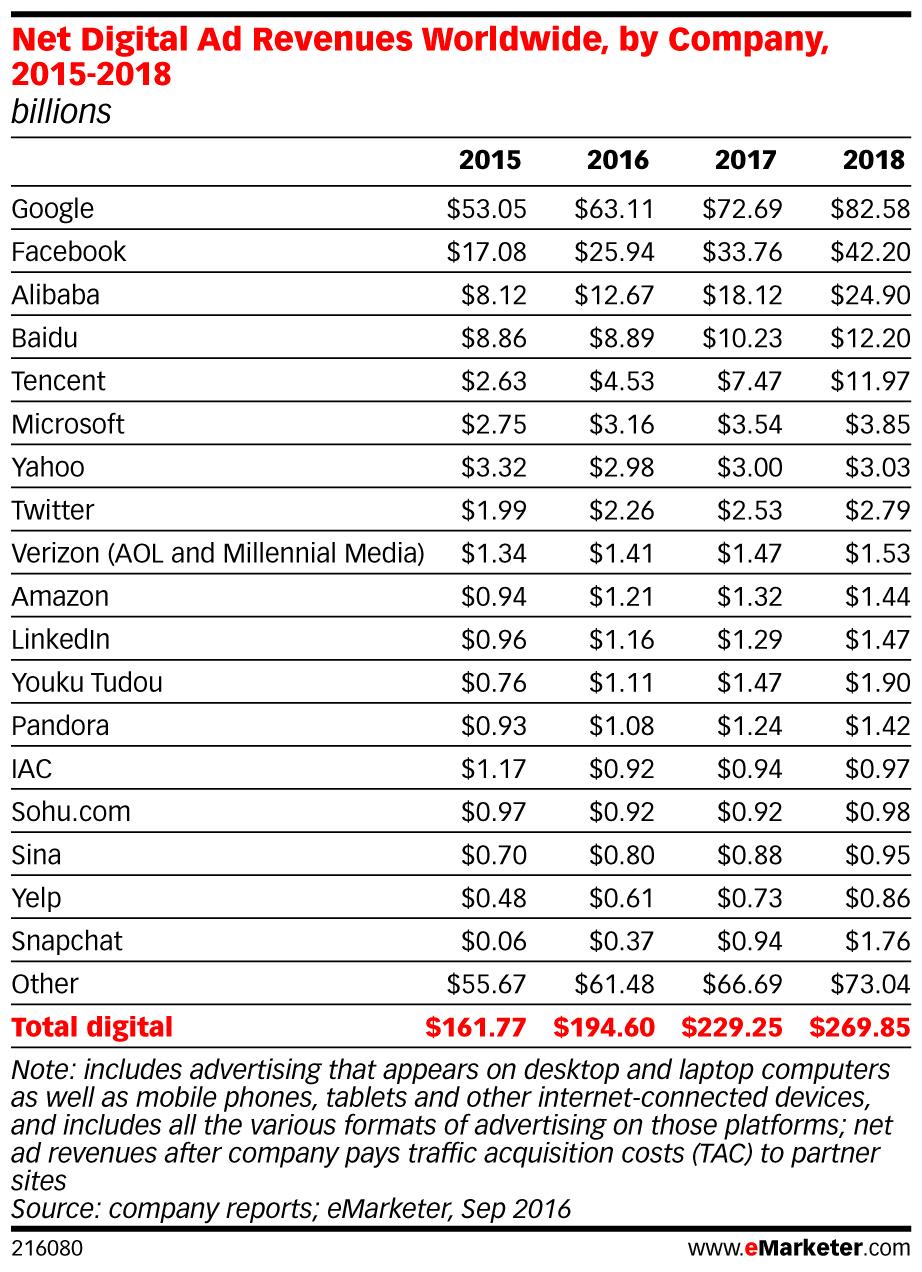

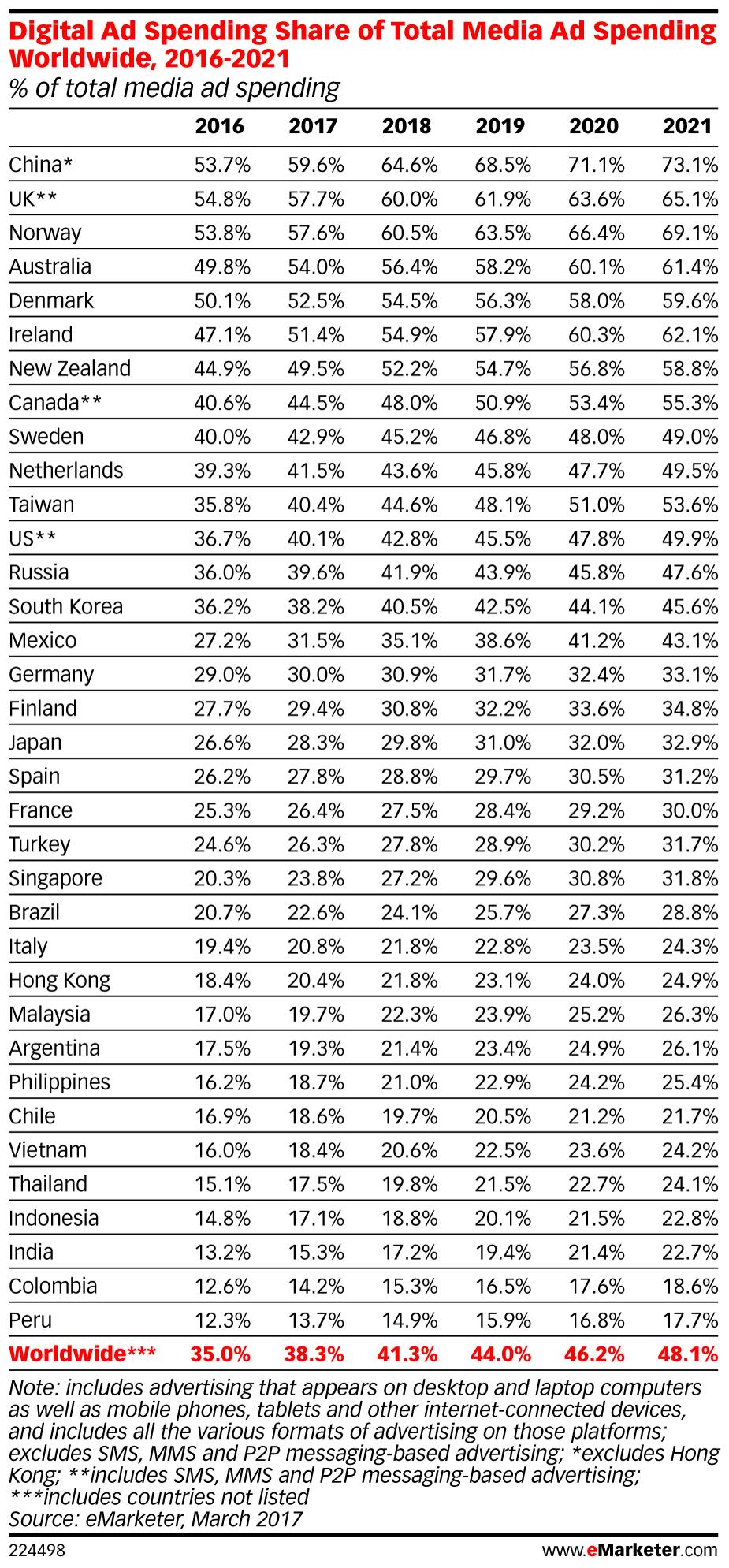

Facebook and Google will continue to dominate the digital market – Google’s global revenues will jump 17.8 per cent this year to take a 33.0 per cent share, while Facebook’s will grow by 35.0 per cent to take a 16.2 per cent slice of the global ad market.

Snapchat

Following its recent IPO eMarketer predicts significant Worldwide growth for Snapchat. In 2017 Snapchat’s global ad revenue, which is made up entirely of mobile display, will grow by 163.3 per cent to US$900.0 million. On the global scale, however Snapchat’s ad business remains small. In 2017, Snapchat will account for 0.6 per cent of the global mobile ad market. By 2019 that share will grow to 1.4 per cent.

Read more about Facebook, Google and Snapchat on eMarketer, here.

Search

Google’s share of the global search market will grow 18.1 per cent to US$61.80 billion. Google’s portion of the global search market will reach US61.6 per cent.

Display

Thanks to Instagram and increased user time overall, Facebook will dominate the global display market and this year revenues will jump 35 per cent to US$36.29 billion representing 33.9 per cent of the global display market. Google by comparison will take a 11.2 per cent share of the global display market.

Shelleen Shum Senior Forecasting Analyst at eMarketer commented: “This year, Facebook and Google will once again emerge as the global leaders in digital advertising scooping up almost half of worldwide digital ad money, tapping on continued strength in mobile and video advertising.

“Facebook and Google’s dominance in mobile advertising remains intact as they take up over half of worldwide mobile ad revenues throughout the forecast period.

“In the immediate future, the only other potential rivals to Facebook and Google are the big 3 Chinese companies, Baidu, Alibaba and Tencent (BAT), who are riding on a wave of rising disposable incomes and a growing tech savvy population in China. The BAT companies are expected to experience resilient digital and mobile ad revenue growth as they start to fully monetize their various advertising products.”

More like this

eMarketer releases latest UK social media usage forecast

eMarketer: India mobile ad spending will grow by 85 per cent