Native advertising: Easing the growing pains for consumers and publishers

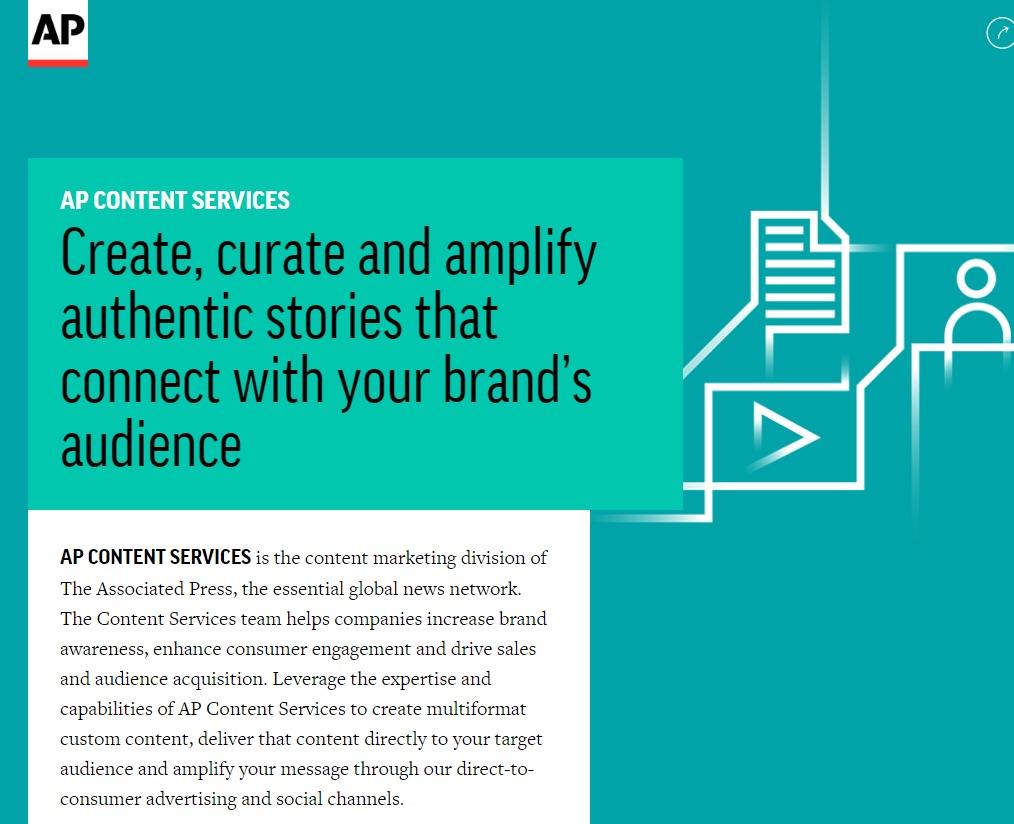

So the recent newsflash from The Associated Press should have been of no surprise: The global news network is taking the plunge, jumping into the deep sea filled with agencies and marketers, and will begin offering a full range of digital advertising services. In offering digital advertising services, the AP becomes a full-service agency called AP Content Services. This new business will provide subscribers with an inventory of sponsored written, video, photo and interactive content to integrate alongside its news service.

This latest development from the hallowed halls of global newsgathering adds to an ongoing conversation—and questions—around the promise and peril of native advertising, which has vociferous supporters and detractors. One key question is how best to wield this double edge sword that has the potential to carve out new revenue streams for publishers, yet threatens to whittle away at their journalistic credibility and risk their readers’ trust? And what other opportunities are emerging in this new epoch of publishing.

A confused customer amid rapid growth

According to a study released late last year by Adyoulike, worldwide spending on native advertising will soar to over $59 billion in 2018. This terrific growth rises in tandem with a threefold increase of IP traffic predicted over the next five years. This signals an anticipated surge in content demand, sponsored content included. Yet many industry analysts maintain that native advertising remains in its infancy and the technological tools to truly monetize it have yet to be fully developed.

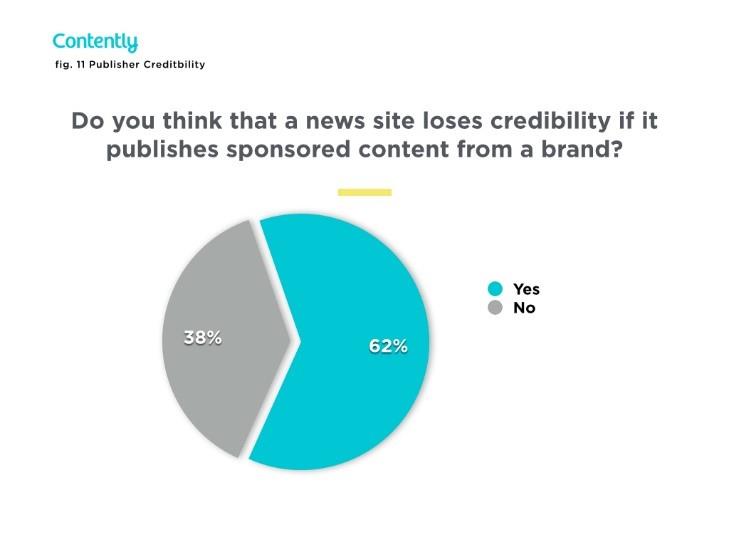

These growing pains are afflicting publishers and their audience alike. A 2015 Contently study found that 62 per cent of readers believe a news site loses credibility if it runs articles sponsored by a brand. On the flip side, while publishers may wrestle with the consequences of merging church and state—the unholy union between editorial with advertising— the same Contently study found that even when an article is labeled as sponsored content, readers remain confused. “Consumers often have a difficult time identifying the brand associated with a piece of native advertising, but it varies greatly, from as low as 63 per cent [on The Onion] to as high as 88 per cent [on Forbes],” the study noted.

And what about the little guy?

As readers remain clearly perplexed and suspicious of the blurring of the line between news and advertising, brands and publishers should take note. As native advertising evolves and blazes a path forward, it prompts other questions: Does this weigh in favour of those with big budgets only or can this scale for the smaller businesses?

According to Purch president Antoine Boulin in a recent Digiday article, for native to deliver performance, “the publisher must put forward an enormous amount of front-end efforts to produce high quality content that meets marketer requests and drives traffic to it, and still, the direct link to ROI can remain murky.”

The lack of resources among outlets outside the big markets is an inherent industry pain point that AP Content identified in the effort to keep its own revenue streams robust.

“We’re hoping to be able to make native advertising available for smaller members who can’t afford to make this stuff or could spend that kind of money,” Paul Caluori, AP’s global director of digital services, told International Business News.

Caluori shines a light on a key point. AP’s venture into native is not a selfless move, for it must hold on to its subscribers and providing plug-and-play sponsored content will likely provide a much-needed revenue boost for publishers in tighter markets. And AP isn’t the only one creating a market to help the little guys survive.

Another example of a native advertising studio serving smaller publishers is Utah-based Deseret Digital Media, which has created Brandforge. Brandforge, a native advertising studio-for-hire serving local media companies, found a sweet spot staking the “middle ground in terms of audience scale and geographic reach,” wrote David Uberti in Columbia Journalism Review. In two years, it landed 30 contracts covering 60 publishers. Uberti notes that local publishers may be even more challenged when navigating the line between editorial and advertising. “Deseret Digital Media’s creation of a native advertising studio-for-hire is an attempt to bridge these divides and help local media get a piece of the action before it’s too late.”

Interestingly, Brandforge has an added angle to its services. They are helping their clients to maintain a strict ethical wall, training local staff on “the minefield between editorial and advertising,” explained Matt Sanders, senior director at Deseret Digital Media. The company has set its sights to sell services to hundreds of publishers by the end of the year. “We’re very confident in our ability to scale,” Sanders told CJR.

There are no easy answers for the publishing industry as it tries to maintain solid financial ground while trying to uphold consumer trust. Yet as other entrepreneurial content studios start to focus attention on local market needs, the promise and perils of native evolves.

More like this

Download Innovation 2015 chapter: Will native advertising save or kill your brand?

Download Native Advertising Trends 2016: The Magazine Media Industry

Innovation chapter download: How to succeed at native advertising