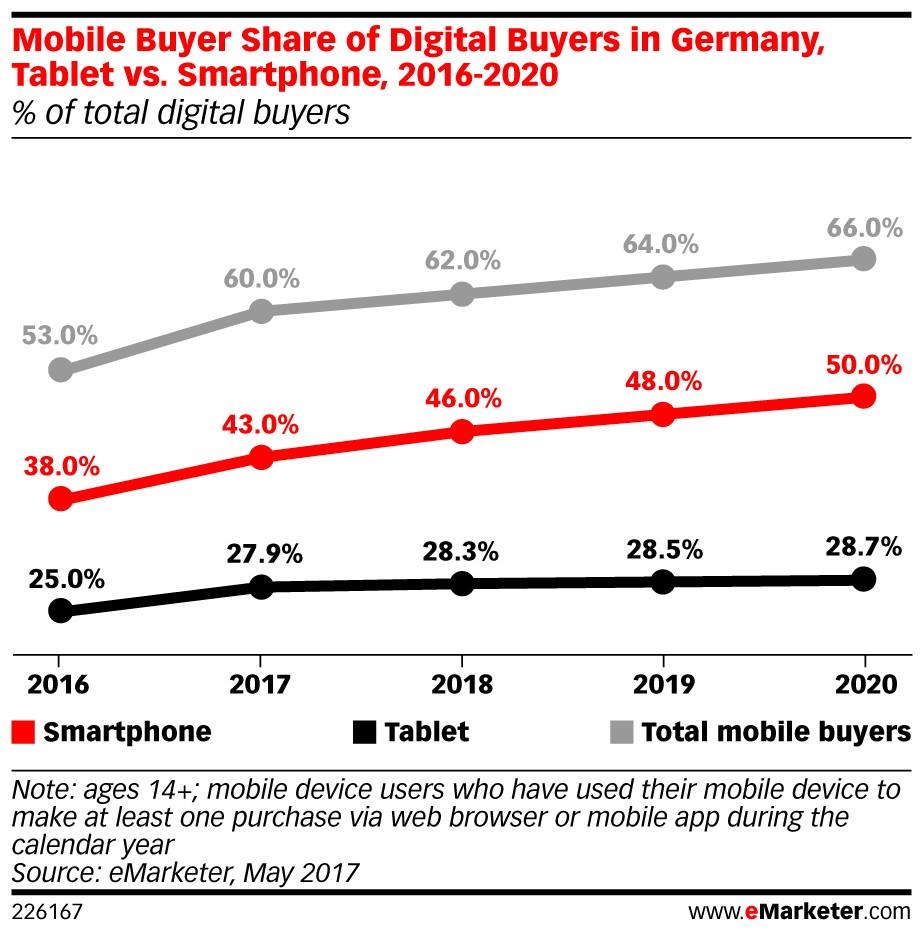

eMarketer: mcommerce moving closer to mainstream in Germany

Despite digital shopper penetration akin to the US and UK, rates of mobile commerce in Germany have lagged in relation to those countries. eMarketer predicts 29.1 million mobile device users in Germany ages 14 and older will make at least one purchase via those devices this year, up nearly 15 per cent from 2016. But that tally will represent just 60 per cent of Germany’s mobile device users, compared with rates of 80.4 per cent in the US and 76.4 per cent in the UK.

The majority of those buyers (71.7 per cent) will make one or more mcommerce purchase via smartphones during the year—a usage rate higher than the 64.6 per cent of US mobile device buyers expected to do the same. But only 46.5 per cent of mobile device buyers in Germany will turn to tablets for mcommerce in 2017, vs. a 68 per cent purchasing rate among tablet users in the US.

By 2020, nearly two-thirds (66 per cent) of digital buyers in Germany will make purchases via a smartphone or a tablet at least once per year, helped not only by greater comfort with the concept of mcommerce but also due to larger screens and other improvements to the mcommerce user experience, eMarketer expects.

Like buying via mobile device, paying at a retailer’s physical POS will also be less common in Germany than in comparable countries. eMarketer predicts just 11.4 per cent of Germany’s mobile phone users will make a proximity mobile payment by taping, swiping or checking in with that device while in a store in 2017. In the US, that percentage will be 20.5 per cent.

However, the number of mobile proximity payment users in Germany will have grown 21.6 per cent by year’s end to nearly 7.3 million. Consistent increases will see that total pass 11 million in 2020, eMarketer predicts.

“Several factors have inhibited takeup of both mcommerce and proximity payments in Germany,” said eMarketer principal analyst Karin von Abrams. “The history of purchasing with cash or invoice is key, though credit cards are increasingly widespread and many digital shoppers are becoming accustomed to using a card online.

“Consumers in Germany also tend to be more concerned about data privacy and digital security than their counterparts in other Western European countries, or in the US. That concern affects mobile and proximity payments in particular.

“In addition, Germany’s population skews markedly toward the older end of the age spectrum, and many of these older residents have fairly conservative shopping and buying habits. That’s changing as the advantages of mobile shopping become clearer, but the process is undoubtedly slower among senior citizens.”

More like this

eMarketer releases latest UK social media usage forecast

eMarketer: India mobile ad spending will grow by 85 per cent

eMarketer: Time spent on mobile internet continues to grow in China