Is native advertising about to ‘eat’ the Asia Pacific region?

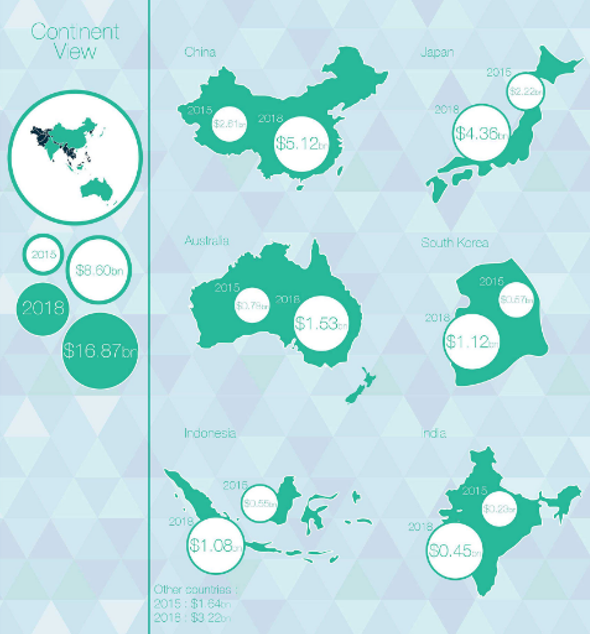

By next year – 2018 – native advertising spend in the Asia Pacific (APAC) region will grow to US $16.87 billion, almost double the spend in 2015, according to a report titled ‘Native advertising is eating the world’ by Adyoulike, a native ad agency based in Europe and the US. The report uses data from PricewaterhouseCoopers (PwC), eMarketer and the Interactive Advertising Bureau (IAB) US to make the prediction.

Looking at the APAC markets measured in the study, the native advertising market in China is expected to grow from US $2.6 billion in 2015 to US $5.12 billion in 2018, in Japan from US $2.22 billion to US $4.36 billion, in Australia from US $0.78 billion to US $1.53 billion, South Korea from US $0.57 billion to US $1.12 billion, Indonesia from US $0.55 billion to US $1.08, India from US $0.23 billion to US $0.45 billion, and other countries in the APAC region from US $1.64 to US $3.22.

Above: Image extracted from Adyoulike’s Native advertising is eating the World infographic. Adyoulike.com

The numbers seem to be in line with similar predictions for the rest of the world, which states that worldwide native ad spend will almost double from US $30.9 billion in 2015 to US $59.35 billion next year. The Global Entertainment and Media Outlook 2015-2019 compiled by PwC echoes the sentiment by including native advertising in the list of the two “fast-growing forms of advertising” – the other being programmatic advertising.

But all is not what it seems, especially in China. Native advertising is not performing as well here as in the rest of the world, says Welby Chen, chief business officer at Inneractive, an independent mobile ad exchange.

Chen argues the reason why native advertising in China is not showing the same return on investment as its international counterparts, is because many of the basic components and best practices for native advertising haven’t been adopted here.

“Where in-feed environments are the most successful format for native ads, as typically practised by global publishers such as Time, Forbes, The Wall Street Journal and The New York Times, where native ads match both the form and function of editorial feeds, most Chinese native ads are not in-feed, thus minimising their native effect,” says Chen. In fact, he suggests, many of these ads are not ‘native’ at all. They are simply “attractive ads”, called native advertising, without any of the characteristics that increase engagement in “Western markets”.

Get stories like these delivered directly in your inbox. Subscribe to our (free) FIPP World newsletter.

Despite an overall positive sentiment, Warc.com, an online service offering advertising best practice, and global content marketing agency King Content air some of these concerns.

The two entities combined forces in 2016 to conduct a survey to establish the true state of native advertising prospects in the Asia Pacific region. To do this, they approached more than 300 marketing and advertising professionals in 16 countries. Respondents included brand owners, creative and media agencies, media owners and content experts.

The findings revealed 69 per cent of marketers in the APAC market have no specific strategy in place for the native advertising medium. Yet, overall, respondents were enthusiastic about native advertising with more than two thirds (67 per cent) saying they had a positive or very positive view of native advertising and the opportunities it offers. Thirty per cent said they felt “ambivalent” towards the trend.

A large percentage of the report deals with positives. These include:

• 59 per cent of respondents said they are likely to recommend investing in native advertising;

• Again 59 per cent said they already use native content to create engagement with audiences;

• 21 per cent said the top motivator for using native content was to increase consumer engagement across digital formats; and

• 20 per cent said native advertising is more credible than traditional advertising.

As credible as it might be perceived, more than half the respondents (57 per cent) believe there is not yet enough proof of the effectiveness of native advertising, with 42 per cent asking for better benchmarks and measurement tools to quantify the impact native advertising investment is having before they can justify increased expenditure.

There also seems to be little proof that respondents believe native advertising is yet effectively leading to sales. While only 24.4 per cent of respondents measure ROI in native advertising in sales itself, most measurements are in ‘soft metrics’ such as ‘engagement’ (59 per cent) and increases in ‘web traffic’. One in ten don’t measure return on investment in native advertising at all.

Despite this, most marketers are expecting huge leaps in native advertising investment in the region by 2020, with 66 per cent anticipating they will be spending more than 10% of their budget on native advertising; 26 per cent of respondents expect to spend more than 30 per cent of their annual budget on native advertising, up from 8 per cent of respondents in 2015.

It does not take too much insight to realise that almost all of the impressive projections and praises being directed towards native advertising are being sung by agencies with a vested interest in native advertising itself. Yet, even the most positive of those can’t deny that conversion to sales remains the major sticking point. Every projection, statistic, metric, percentage or benchmark used to express warm approval of native advertising will eventually come to nothing if tangible ways cannot be found to utilise all these positive effects of native advertising and convert it into sales – whether through tangible evidence of lead nurturing or actual sales conversion itself.

More like this

The battle for attention in a digital world [incl. video interview]