Mapping the digital newsstands market

Digital Content Delivery Systems (DCDS) is the over-arching term that captures the changing face of digital magazines. These are now available in various formats (from PDFs through to apps), in various places (from open newsstands through to closed user groups) and with various business models (from All-You-Can-Read through to subscriptions to individual publications and on to single copy purchases).

Defining the shape of the market

Digital magazines are just one of many ways of delivering content to the end consumer, with both print and digital platforms continuing to run alongside each other in parallel.

In most consumer magazine markets, the print issue remains the “gold standard” in three respects: (1) what the “magazine experience” actually feels like in terms of how the content is navigated by the reader; (2) how the content is structured around a curated collection of content – the “issue”; and (3) how much can be charged for it.

Most digital issues are simply the print product converted into a digital format – the structure remains the same, but the consumer’s perception of the experience and what the value of the product is, can both change.

Multiple content products

The other products, all digital, usually deliver content which has been atomised into smaller information units, often article-level, rather than the fully curated bundle of an issue:

- Website and/or app

- Newsletter

- Video: streamed channels and downloads

- Audio: streamed channels and downloadable podcasts.

- Social platforms: branded publisher presence and distributed / off-platform

Beyond these core content products is a range of add-on products and services which include live events, transactional marketplaces, the sale of linked goods and services (e.g. holidays, insurance and wine clubs) and general ecommerce activity.

So, the “digital magazine” is just one digital content delivery system (DCDS) among many, but an enduring one.

There are two key factors behind all this. Firstly, the number of content products is increasing. Secondly, these products are merging into each other to create complex and hybrid bundles, rather than being standalone and distinct platforms.

The morphing consumer

Yet what is driving all these changes is an increasing complex consumer, who is both more demanding and also more difficult to define in traditional demographic terms.

- The connected consumer is hardwired into a digital world.

- The pressured consumer is increasingly fickle, with increasing demands on their time and money.

- The low-friction consumer wants to choose, buy and consume as easily and as quickly as possible.

- The ethical consumer has real concerns about the social and environmental impact of their behaviours and spend. This has become an important factor in the choice between print and digital magazines.

- The home-based consumer is still in the process of rethinking their whole lifestyle / work style and how, where and why they spend their money.

- The individualised consumer wants to be treated as a completely unique person.

All these factors add up – and sometimes collide – to make for a very complex consumer marketplace.

Defining the size of the market

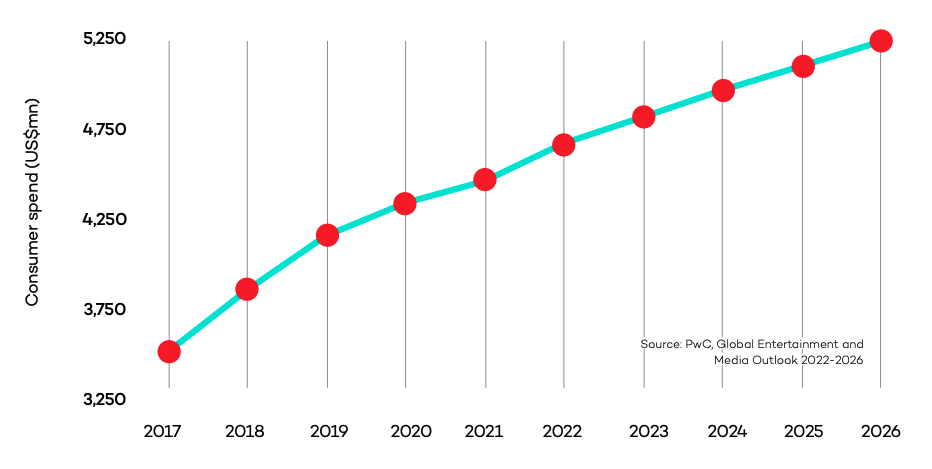

PwC in their annual Global Entertainment and Media Outlook 2022-2026 report estimate that the total global consumer spend on digital content for the consumer magazine industry in 2022 was US$4.7bn. That figure includes all digital platforms, from digital magazines through to paid website access.

- Digital reader revenues were showing strong growth pre-COVID averaging +9% per year in 2018 and 2019.

- This rate of growth slowed markedly to +5% in 2020 and +3% in 2021. During this period, digital magazines were often given away free: (1) to ensure continuity of delivery to the consumer when print supplies were disrupted or (2) being dropped into value-added subscription bundles, which themselves were often heavily discounted.

- Digital revenues have started to accelerate once more (+4.5% in 2022) before settling into a predicted steady +3% through to 2026. This is in contrast to the forecast decline of print reader revenues of -2% per year over the same period.

- In 2017, digital accounted for 7.6% of total reader revenues. In 2022, this has grown to 11.5%. By 2026, it is predicted to increase to 14%.

Global spend on digital content in digital magazines

The figures highlight that print remains an important platform for consumer magazines. Yet it also suggests that there is the potential to grow digital platforms much more quickly with more focused activity and firmer pricing.

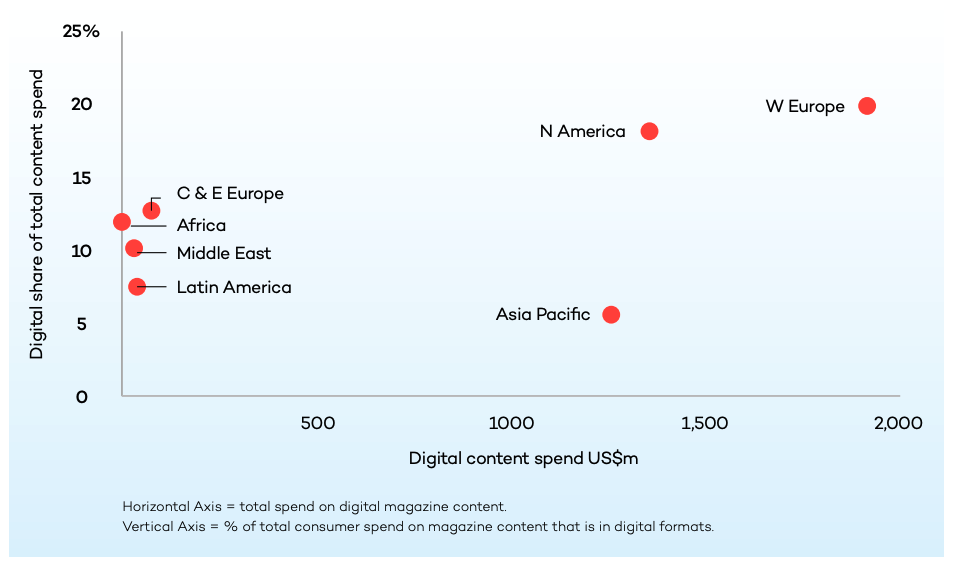

These global figures conceal significant differences around the world. The chart below maps what is happening at a regional level.

Regions digital spend vs digital share: 2022

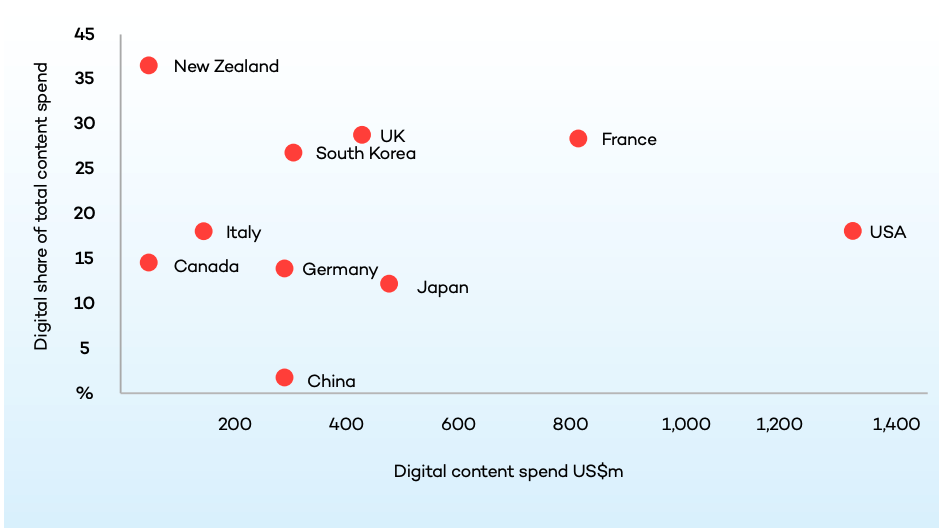

Western Europe is both the largest and the most digital region with a 2022 digital content spend of US$1.9 billion, which accounts for 20% of total reader spending on content.

- Three countries stand out as leading the zone in terms of their digital share: UK (29%), France (29%) and Ireland (25%).

- Other important markets include Italy (18%), Germany (14%) and the Netherlands (14%).

North America is the second largest digital market and has a strong 18% digital share, but this still lags behind Western Europe, with the USA (18%) slightly more digital than Canada (15%).

Asia Pacific is the third largest digital market, but with a low 6% digital share figure. This is pulled down by China which has a low 2% digital share and India (3%) – both remain very strong print markets. When these are stripped out, there are some very strong digital countries, notably New Zealand and South Korea.

Top 10 countries digital spend vs digital share: 2022

The remaining four regions are much smaller and closer in size, clustering around the global average digital share of 11.5%. Dig into each of these regions and the digital shares vary markedly from country to country. Yet Latin America is the most extreme ranging from a very high digital share in Peru down to very low figures for Argentina and Colombia.

This insight article is part of the FIPP report Digital Newsstands – the definitive guide, available only to FIPP members. You can download the full report here. The report, made in partnership with PressReader, is authored by Jim Bilton, Managing Director at Wessenden Marketing.

Not a FIPP member yet? You can sign up via the report page.