According to Nielsen, sales in the Southeast Asian premium market grew 21 per cent over two years, compared to 8 per cent growth experienced by other mainstream categories. This is a significant increase, and it makes sense that brands would want a slice of this growing pie.

As marketers clamour to establish their brands in the premium market and reach out to affluent consumers, the first thing to ask is: What defines a product as “premium”?

The layperson or even marketers often associate “premium” with “exclusivity”, but the findings of the Global Premiumization Report might just surprise you. While exclusivity still features, only 22 per cent of global consumers associated it with “premium-ness”. In fact, it ranks pretty much below most other factors.

Premium is more than exclusivity

In a previous post on our SPH corporate blog, we shared how, with the onset of digital marketing, luxury brands had to manage their exclusivity while maintaining accessibility in order to reach and engage new audiences.

However, it now seems that exclusivity alone is not enough to grant brands premium status. To further complicate things, there still does not seem to be an agreement on what the new definition should be. For the most affluent consumers at the top five per cent of the population, premium is associated with “craftsmanship” and “upscale”. For millennials, it is “quality”, and “performance”.

Amidst these associations, however, one stands out for being consistently mentioned across different consumer segments: trust. Trust was cited by most respondents in Asia in defining a premium product. Specifically, the product must be from a trusted brand.

Building trust

This finding is particularly relevant for brand marketers in the region who want a share of the very quickly growing premium market. To do so, they might have to consider focusing their strategy on building consumers’ trust in their product.

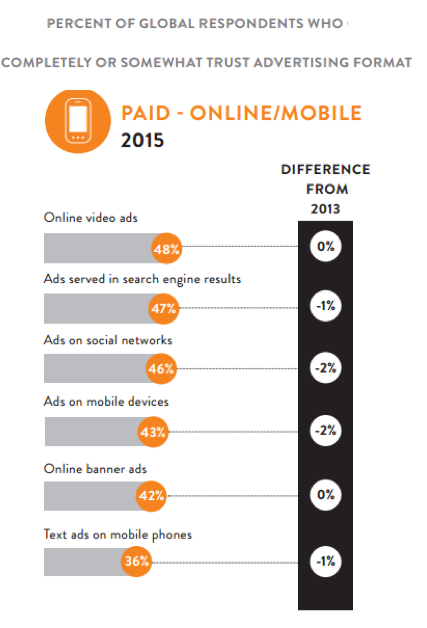

This is no easy feat, as trust in a brand is not something that can be built overnight, especially with the knowledge that trust in digital advertising formats is low. That is not to say that brands have to build trust from scratch.

They can benefit through partnerships with a trusted platform and brand, and leverage on consumers’ inherent trust in said platform and brand.

Source: Nielsen’s Global Trust in Advertising Report

Using magazines to build trust

According to Nielsen’s Global Trust in Advertising Report, content remains one of the most trusted advertising formats, with 58 per cent of respondents agreeing with the statement. This finding is even more pronounced in the Asia-Pacific region, with 71 per cent of respondents trusting advertisements in the form of editorial content.

In another study by Adsense, magazine content is trusted more than other media. This is due to the nature in which the content is researched and presented, which is seen as more open and honest as compared to other media types.

This trust in magazine content also spills over to advertising content in magazines, and advertisers have benefited from this trust, with 46 per cent of magazine readers who had seen an advertising campaign in a magazine were more likely to purchase from the advertised brand.

Get stories like these delivered to your inbox every week. Subscribe to our (free) FIPP World newsletter.

It seems that having consumers’ trust elevates a product’s premium status. “Trust”, then, is the sure way into the premium market. Luxury brand marketers whose brands are already part of this ecosystem, need to utilize these findings to review their current marketing strategy, shifting the focus from establishing exclusivity of the brand to building trust in their brand.

Similarly, for other brands which aspire to be part of the ecosystem, understanding this presents the opportunity to break into the premium market. To do so, they will have to double up on audience engagement to build up brand trust. However, there is no need for marketers to start from ground zero, or even do it alone. Research has shown that consumers trust magazines, and brands can leverage the unique relationship between the medium and the consumer to create partnerships in the form of 360 total solutions encompassing multiple consumer touchpoints, which magazines are adept at.

For more:

SPH Magazines’ 360 solutions keep the consumer at the heart of our focus and within reach. For brands who are looking to engage their audience through multiple touchpoints, find out more here.

More like this

The Economist’s ‘globally curious’ audience strategy in Asia

Asia-Pacific’s mobile conundrum

Is native advertising about to ‘eat’ the Asia Pacific region?