Report launch: Digital Subscription Snapshot 2021 Q2 data update

A slowdown in growth for the New York Times, promising forays into digital subscriptions for a handful of magazines and the blockbusting success of Disney+. These are some of the headline findings of FIPP and CeleraOne’s Digital Subscription Snapshot 2021 Q2, which was launched on the opening day of the D2C Summit.

Casting an expert eye over the data alongside FIPP CEO James Hewes, CeleraOne Managing Director York Walterscheid said that while the Snapshot showed the growth of last year is continuing, publishers are clearly preparing for a time when Covid-19 is not driving subscriptions.

“A big topic at the moment is discussions around post-Covid strategies and tactics – what can we do to keep the great conversion numbers or keep the new subscribers we got,” he said. “Also, on all the agendas of the publishers – small, medium or large – is digitisation in all areas and upgrading of their tech stack.

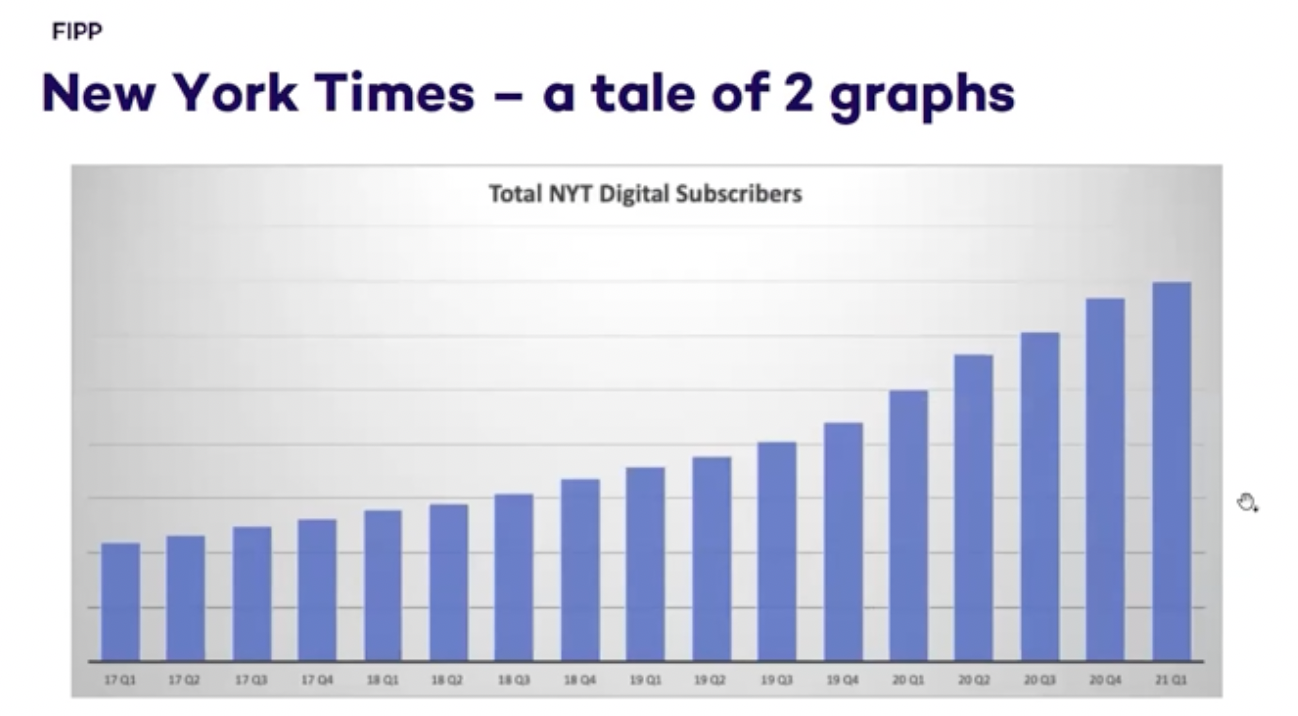

NYT’s bad quarter – don’t believe the hype

Many of the headlines from this year’s report will focus on the slowdown in growth at the New York Times. The quarterly growth in digital subscriber numbers for NYT was the lowest since Q2 2018, at just 4.5 per cent. However, as Hewes pointed out, that doesn’t tell the whole story.

“It’s down from an average of about 10 per cent in 2020 but it’s worth remembering that this represents a 167,000 new subscribers in one quarter, which is more than most people’s total subscribers. And when you get to 7 million subscribers as they have, it’s hard to drive the same kind of double-digit growth rate that you did when you were smaller.”

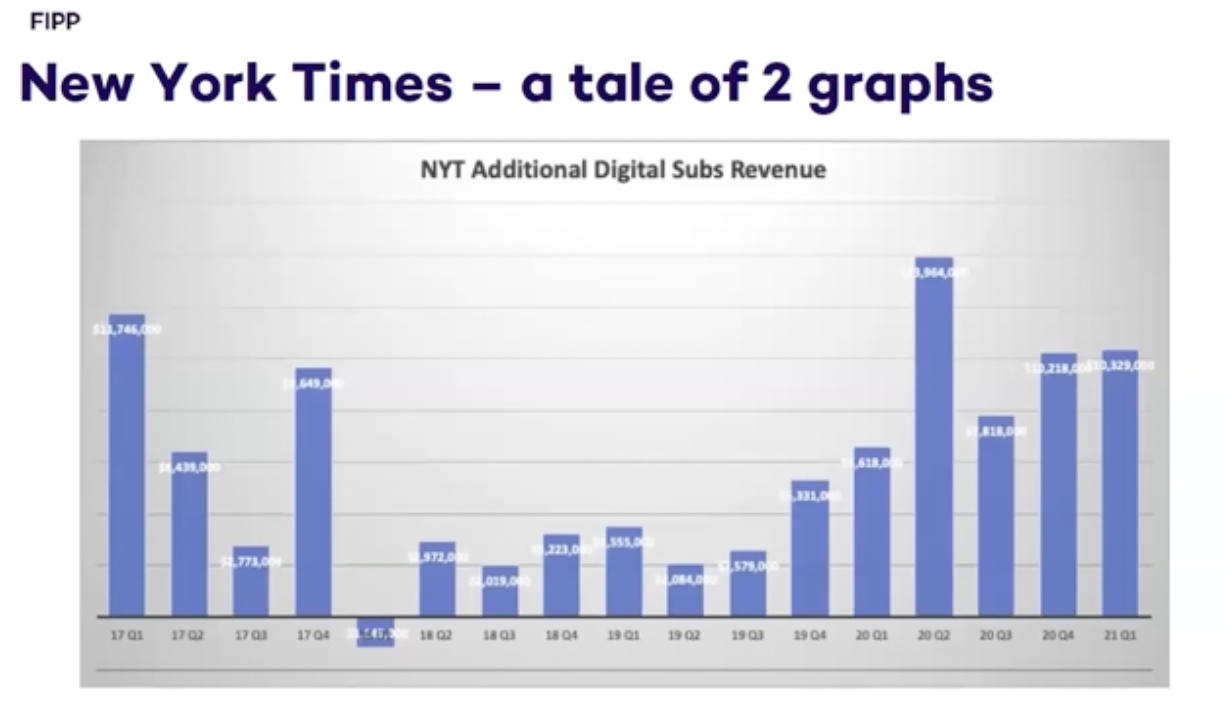

If you look at the value of the New York Times’ business, the picture becomes even clearer. The ‘bad quarter’ still delivered more than $10 million in new digital subscriber revenue – more money in one quarter than all quarters back to the beginning of 2017 bar two.

Also, the NYT’s rolling annual digital subscription revenue is now a mammoth $650 million and digital subscriptions became the single largest revenue stream for the company for the first time. “It shows what is possible when you really dedicate yourself to the digital subscription business,” Hewes added.

Also doing well is the The Washington Post, the newspaper moving past 3 million subscribers, while The Wall Street Journal continues to show growth. A surprise performer has been The Athletic, which despite all the disruption to live sport, has put on 20 per cent more subscribers towards the end of 2020.

A new entry among top performers was Barrons, a weekly financial magazine owned by Dow Jones, which is making huge strides with 500,000 subscribers already. BILD Plus is also continuing to show steady and consistent growth to emerge into the top 10 global brands in this space.

Magazines are making headway

The Digital Subscription Snapshot 2021 Q2 shows that there is early evidence of magazine success. Magazine brands have been very slow to adopt paywalls with only a few brands featuring on the list. From the ones that have made the Snapshot there are some encouraging signs.

The Atlantic has showed some staggering growth and is up to 400,000 subscribers and rising quickly. Three other brands are showing similar patterns – The New Yorker, National Geographic and Wired are all reporting healthy subscriber numbers and are all growing at about 5 per cent per quarter.

According to Walterscheid some magazine publishers still struggle to define their digital value-add. “They have periodic publishing dates and it doesn’t really fit with the behaviour of how people read today. They have great content but the way of producing and publishing content is probably not the right way. And some struggle to monetise that.”

In the middle of the market there’s a mixed bag of performance. The Economist and Le Monde enjoyed big increases across 2019 and 2020 but there are signs that this has slowed to a halt in 2021.

The LA Times and the two Axel Springer titles – BILD and Die Welt – continue to show very steady progress but it is the performance of The Telegraph that is the most remarkable.

The newspaper, which has doubled its base in a year and are now heading up to 500,000 subscribers, will soon be the largest newspaper in Britain for digital subscriptions. The Telegraph has achieved this with a very tight focus on the subscription business and by not being distracted by other opportunities – to the extent that they have outsourced their print advertising sales.

Hewes pointed out that the success in digital subscriptions is not just something for the big companies. “Some of the companies listed in the Snapshot are smaller businesses but by committing to a digital subs strategy even smaller businesses have been able to register significant success.

“This strategy doesn’t just work for national papers. There are plenty of regional newspapers here showing significant numbers.”

See the full session below:

Back the Mouse House in the streaming wars

In terms of OTT and VOD streaming services the big change has been the launch of Disney+ which, despite being the last entrant in streaming, may have won the streaming wars. Its success is driven by a very clear strategy, which includes recalling content from other services and acquiring good IP and investing in it.

“If you have that magic combination of a great brand, great content investment and creative expertise then you can really deliver results,” said Hewes. “It’s a lesson that applies to any digital subscription business, whether it’s video or not.”

Disney+ now has more than a 100 million subscribers and is growing at around 15 per cent per quarter. At that rate in 12 months it will be bigger than Netflix.

Heading into a post-Covid world

Giving advice to publishers as they head into a post-Covid world, Walterscheid said there are two triggers that need to intensively be discussed.

“Firstly you need to discuss how to keep your conversion rate and look at the tech stack you have,” he said. “Is it modern enough to make good conversions and can you play around with modules, tech stacks, paywalls and audience development tools to modify and influence the conversion rate? Also important for conversion is driving engagement and understanding the audience – what they want and what they do.

“Secondly, you have to look at the churn – how can you keep all these new subscribers. Did they only come to you because they were looking for Covid news or were they bored because of social distancing?

“The big question again is – what drove these guys to sign up, to subscribe. You have to ask yourself the question – how can I still drive the engagement if these guys are not present on my website? How can I contact them off page? So off-page and on-page strategies need to be discussed and everything around personalisation and engagement.”