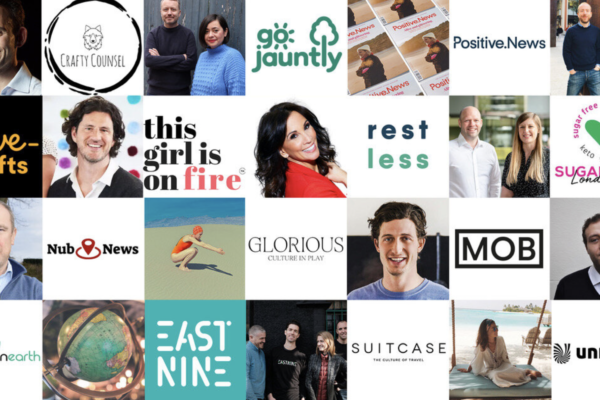

The state of UK media startups – Mark Maddox and Kevin Sutherland of Vida Media highlight their challenges and opportunities

The last few years has witnessed a rationalisation in the UK media with the number of premium brands diminishing as a result of mergers and acquisitions.