Time Inc. UK sold to private equity group

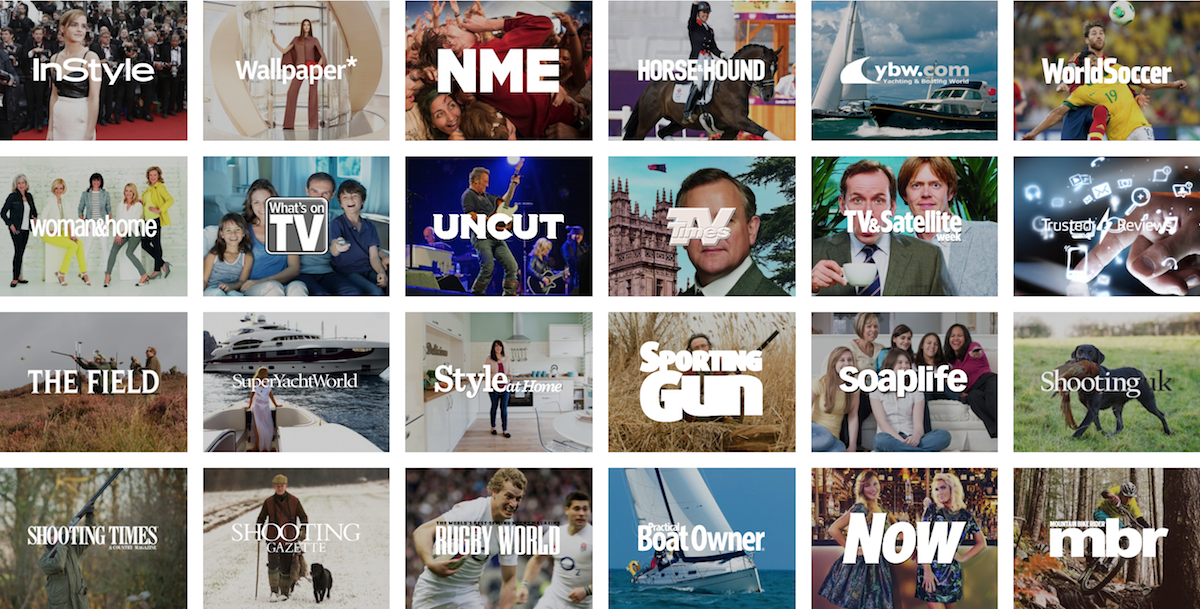

Meredith acquired Time Inc. UK on January 31st 2018, along with the rest of the Time Inc. group. At that time, Time was itself looking for a buyer for the Time Inc. UK portfolio, which includes magazine brands such as NME, Marie Claire, and Country Life. In total, the publishing house’s 50-plus brands reach 17 million adults and 13 million online users across the UK, with titles spanning a range of interest areas from entertainment and women’s lifestyle to luxury, sports and technology.

“The separation of Time Inc. UK from its US parent had been much rumoured, even prior to the recent takeover by Meredith,” said James Hewes, president and CEO of FIPP. “It’s clearly great news for the UK team, giving them some certainty after years of what was clearly a strained relationship with Time Inc.”

|

James Hewes, FIPP president and CEO

“As IPC, this business was the UK’s largest magazine company and Epiris clearly have one eye on returning them to those glory days. From a portfolio point of view there is much to be positive about and I expect to see a lot more multi-platform activity around their portfolio of special interest brands. This deal is just the latest in the absolute flood of merger and acquisition activity going at the moment and I understand there’s a few more surprises to come later in the year.”

The Epiris LLP private equity group targets control positions in UK-centric businesses with an enterprise value of between GBP £75 million and £500 million, deploying between £40 million and £150 million of equity. The Time Inc. UK transaction is being led for Epiris LLP by Chris Hanna, Ian Wood and Nicola Gray, and the company is being advised by Jefferies International, PwC and Macfarlanes.

In a press statement put out by the investment group on Monday, Chris Hanna, Partner at Epiris, said: “At its heart this is a diverse, robust and cash-generative business. We intend to bring clarity and simplicity to it, to focus on maximising the potential of its high-quality portfolio.”

It is now believed that Epiris is also considering a bid for assets belonging to Dennis, the publisher of titles including The Week, Viz and Men’s Fitness, for £75m – £100m. To strengthen industry experience around the Time Inc. portfolio, Epiris has brought in Sir Bernard Gray, the chairman of New Scientist and formerly a non-executive director of Immediate Media, as executive chairman.

Marcus Rich, CEO of Time Inc. UK will remain with the company, and added: “Time Inc. UK is home to some of the best known brands in the UK and we are delighted to be partnering with Epiris and with Bernard [Gray] as we continue our transformation journey. They share the same vision for our business and we are excited by the fresh insight they will bring as we shape our shared plans for the business in the years ahead.”

|

Marcus Rich, CEO of Time Inc. UK

While some media outlets are reporting potential job cuts and title sales, others experts are viewing the acquisition as a positive move for the industry. With profits in the region of £30m, and 2017 revenues of around £250m, Time Inc. UK remains a profitable magazine business. Colin Morrison, the Australian publishing executive who serves as chairman, non-executive director, and consultant to several media and digital companies across Europe and Asia, and has followed the Meredith-Time story closely, told FIPP:

“This is dramatic news because Time Inc. UK is (still) one of Europe’s leading magazine-media groups. But it is good news because the once mighty company has been relatively unloved and unwanted by its owners for too many years. This private equity-backed deal just might signal an exciting time of seeking to modernise and maximise the potential of a company which still owns some of the UK’s most famous media brands. It won’t be easy or painless. There will have to be rationalisation and major change. But it could be the start of something pretty exciting.”

You can read the official Meredith press release here, and stay tuned to the FIPP website for further updates.

Meredith and Time Inc. UK are members pf FIPP.

More like this

Meredith Corporation to acquire Time Inc. to create premier media and marketing company

‘Betting on the future’ – what others say about Meredith’s prospective Time Inc. deal

Meredith’s purchase of Time Inc. ‘a truly transformative moment’ – Steve Lacy