Zenith forecasts mobile devices to lift online video viewing by 20 per cent in 2017

By online video we mean all video content viewed over an internet connection, including broadcaster-owned platforms like Hulu, ‘over-the-top’ subscription services like Netflix, video-sharing sites like YouTube, and videos viewed on social media, like Facebook.

Since we started producing this report two years ago, the amount of time people spend viewing online video has grown 42 per cent, and the online video advertising market has expanded by 53 per cent. Viewing on mobile devices like smartphones has overtaken viewing on fixed devices, like laptop and desktop computers and smart TVs. Better displays, faster connections and cheaper data packages has made it easier than ever for people to watch whatever video they want, when they want, and where they want.

The amount of available video content is rising rapidly across all platforms, but social media platforms have been particularly quick to embrace video over the last couple of years. They have added tools to encourage users and brands to create and share videos, and are now broadcasting live video streams, such as sport events.

In many markets Facebook is now the second-biggest supplier of video content, after YouTube.

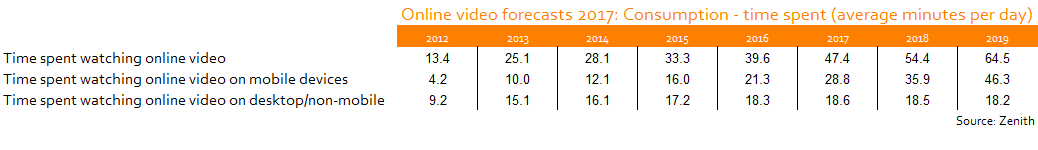

We forecast online video viewing to rise 20 per cent this year. Global consumers will spend an average of 47.4 minutes a day viewing videos online this year, up from 39.6 minutes in 2016. This increase will be driven by a 35 per cent increase in viewing on mobile devices to 28.8 minutes a day, while viewing on fixed devices will rise by just 2 per cent to 18.6 minutes a day.

Video viewing on fixed devices to peak this year, as viewing goes mobile

2017 will be the peak year of fixed-device video, which global consumers will spend an average of 19 minutes a day viewing. Viewing on smart TVs continues to rise, but not rapidly enough to compensate for the decline in viewing on desktops and laptops, as consumers shift their attention to mobile devices. We forecast viewing on fixed devices to shrink 1 per cent in 2018 and 2 per cent in 2019.

Meanwhile mobile video viewing – averaging 29 minutes a day this year – will grow 25 per cent in 2018 and 29 per cent in 2019, driven by the spread of mobile devices, improved displays and faster mobile data connections. By 2019, mobile devices will account for 72 per cent of all online video viewing, up from 61 per cent this year.

Online video adspend to grow 23 per cent in 2017

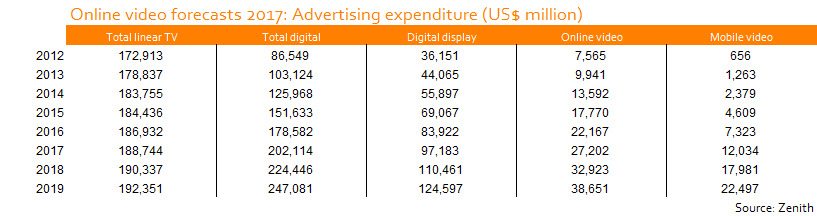

The rapid growth of video consumption is leading to equally rapid growth in video advertising. We forecast global expenditure on online video advertising to grow 23% in 2017 to US$27.2bn, up from US$22.2bn in 2016. Annual growth peaked at 37 per cent in 2014, and has since fallen gradually as online video advertising has grown in scale. We forecast 21 per cent growth in 2018, and 17 per cent growth in 2019, when online video ad expenditure will reach US$38.7bn.

Online video advertising is becoming steadily more important to the digital display advertising market, just as video is becoming an integral part of the consumer’s experience of the internet. By 2019 online video will account for 31 per cent of total expenditure on digital display advertising, up from 28 per cent in 2017, and 21 per cent in 2012.

Online video advertising will be mobile first in 2018

Although most video viewing is now mobile, most advertising expenditure goes to fixed devices. We estimate fixed video adspend at US$15.2bn this year, compared to mobile video adspend at US$12.0bn. Videos viewed on fixed devices are displayed on larger screens, and often in less distracting environments, than those viewed on mobile devices. They are more effective at conveying brand messages, and so command a price premium from advertisers. By next year, though, that will no longer outweigh the higher volume of mobile video viewing, and mobile video adspend – at US$18.0bn – will overtake fixed video adspend – at US$15.0bn.

More like this

Zenith: 26 per cent of media consumption will be mobile in 2019

Zenith report: Underlying growth in global adspend strengthens in 2017

Zenith adspend forecasts reveal unprecedented stability of the global ad market