How Meredith fuels its revenue growth across channels

“It’s a great milestone for us as a company,” he said. “Digital is a growth engine for Meredith, and we’ve now enjoyed several consecutive years of organic, double-digit digital advertising revenue growth in a business that generated close to 40 per cent of our total national advertising revenue in our last fiscal quarter. We’re very excited about that.”

Total advertising revenue growth continues to be a key objective for Meredith’s National Media Group, and the recent inflection represents a key step in that direction, Werther said.

“Both print and digital advertising continue to be significant revenue streams for us, and continue to work well together to drive better results throughout the purchase funnel for our marketing clients and agency partners.”

According to recent fiscal 2017 2nd quarter results, Meredith’s digital advertising revenue rose 16 per cent, and accounted for 38 per cent of total National Media Group advertising revenues. As well, the company’s share of total magazine advertising revenues increased to 13.8 per cent from 12.5 per cent.

“We’re at the point now where digital advertising has gotten big enough that it is growing the total,” said Mike Lovell, investor relations director at Meredith.

Growth strategy and results focus

According to Werther, several factors continue to fuel Meredith advertising growth. The secret to Meredith’s success is a superfecta of elements that work together to help the company diversify its advertising and consumer revenue to more premium forms of monetisation. This drives better return on advertising spend for clients and agencies, and a better ROI for Meredith.

Meredith’s strategy focuses on the intersection of four pillars: best-in-class branded experiences, development and growth of an at-scale and highly-engaged female audience (with a particular focus on millennial women), differentiated first-party data, insights and analytics, and proprietary technology platforms.

“Those pillars collectively enable us to put the right offerings in front of the right consumer on the right device at the right time,” Werther said. Into 2017, Meredith’s objective is to continue to profitably drive advertising growth, he added.

Meredith has invested in experiences across channels. “Our objective is to be wherever the consumer is,” Werther said. “If her preference is to consume content in a physical format, then obviously we want to reach and engage her with our magazines; if it’s a more digital, mobile-first or video-centric consumption channel they’re looking for, again, we will reach them there.”

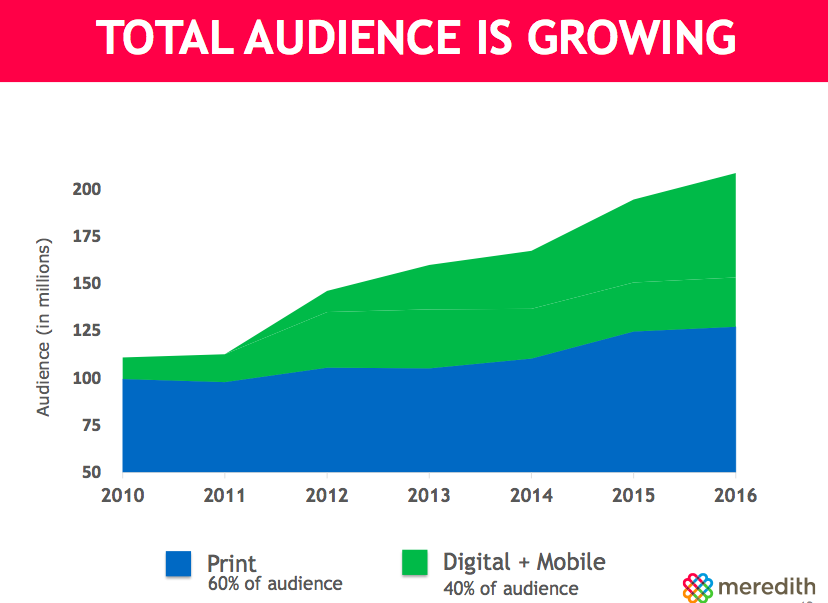

As the chart suggests, Meredith’s audience and reach is growing over time. The company now serves 102 million unduplicated women every month. The company also reaches three-quarters of all millennial women in the US across channels, and over half of all millennial women in digital channels alone.

“Our print audience (also) continues to grow,” Lovell said. “On top of that, we have a significant digital business, where our audience is almost as big as, and is growing faster than our print audience.”

Understanding the consumption habits of that audience has been a big part of the growth strategy for Meredith, and Meredith’s insights and analytics that affords its strategic partners the chance to shape not only their media strategy, but also in many cases, their product strategy.

“We’re able to do that because we can identify, for example, early trends before they become macro trends, and allow our marketing partners to get out in front of that consumption growth,” Werther said.

In addition to its proprietary insights and analytics, Meredith’s growth strategy has also leveraged proprietary technology. “We’ve invested in technology platforms that enable us to leverage our data to provide innovative and results-driven ad products to marketers, in areas of growth and importance like native advertising, video, shopper marketing, influencer marketing and ‘always-on’ content-led marketing campaigns,” Werther said.

Meredith’s ability to drive results, from increased brand awareness to lift in sales, has long been a cornerstone of its cross-channel marketing partnerships. Technology and proprietary insights and analytics have allowed the company to prove that the pillars of the growth strategy work together to move consumers through the purchase funnel.

Revenue diversification

Circulation also has been an important driver of growth. “Circulation continues to be a steady source of revenue and profit, it’s been relatively stable over time because consumers value our content and will pay for it,” he said.

According to the recent fiscal 2017 report, Meredith’s circulation revenues increased to $67 million, driven by the release of The Magnolia Journal in October 2016.

In addition to traditional magazine subscriptions, Werther said that Meredith continues to look to build out other forms of consumer revenue, including brand licensing, commerce, and new paid products: For example, Meredith has the second-largest licensing programme in the world, behind Disney.

“When we think about building our brands, we look to do so from a 360-degree perspective,” Werther explained. “Just as diversified, cross-channel ad monetisation is a key component, so too are diversified consumer-revenue-focused offerings. Ideally, we look to take a brand that may be strong in one particular channel and look to capitalise on its brand strength in several additional channels.”

For example, purchasing AllRecipes in 2012 was a transformative opportunity for the company. The acquisition doubled Meredith’s digital reach and established the company as a world leader in digital food content. In addition to being the largest digital food property in the US, Allrecipes also is a top digital player in many of the 17 international markets in which it operates. Soon after, Meredith launched a line of brand extensions including an AllRecipes print magazine, a line of Allrecipes branded cookware and, most recently, an Allrecipes Dinner Spinner television show.

Within the past year alone, Meredith’s Shape magazine also launched an activewear line, as well as an Eating Well branded line of frozen foods in partnership with Bellisio.

“We’ve been pretty successful on the brand licensing front and it’s something we’re proud of,” Werther said. “We think it shows the power of, and the affinity that consumers have for, our brands – as well as our ability to drive increased sales for our strategic retail and merchandising partners.”

Related: See Mike Lovell’s presentation at FIPP London – sliders and video

Meredith Corporation is a member of FIPP.

More like this

How Meredith built Allrecipes into a digital-to-print, multichannel success

How Meredith’s programmatic advertising is evolving

Meredith delivers record fiscal 2017 second quarter and first half results