BuzzFeed founder’s fixes for ‘media in crisis’ has a familiar ring

This includes:

- Fixing the relationship between media and tech

- Evolving the revenue model

- Building a portfolio of strong brands

- New organisational structure

Common challenges

The thrust of Peretti’s argument is that quality publishers do not receive sufficient reward from platforms and cannot survive on an advertising model alone that pitches you directly against the platforms. They therefore have to build out a portfolio of brands, including general interest brands like news and special interest like food, diversify revenue streams beyond advertising and adapt the organisational structure to deliver on these objectives.

Peretti, tellingly, uses Tasty, BuzzFeed’s special interest food network, as an example of how BuzzFeed plans to build out its portfolio and diversify revenue streams. He is not the first web native publisher identifying the value of verticals and surely won’t be the last. For example, earlier this year, Neil Vogel, CEO of About.com (since renamed Dotdash as part of the business’ transformation), explained why About.com was unbundling into five core verticals “to become more like a Condé Nast, Hearst or Meredith”.

Vogel spoke candidly about how their original attempts to transform About.com – then still aimed at building a scaled model – floundered. The problem was that “that model was from the [Internet in the] 90’s, where scaled brands equalled trust. We were focused on the wrong thing, which was rebuilding a general interest brand like AOL, MSN, Yahoo or About.com.” Now, it is not true that scale equals trust, he said. “Now vertical brands are what people trust. These are the brands that are meaningful today.”

The value of special interest, or vertical, brands, tapping into deep interests or passions of audiences, developing relationships of trust and building a diversified revenue model around these relationships has long been something advocated here at FIPP. Likewise, have FIPP members dealt – and continue to deal – with the relationship with platforms, changing brand portfolios, diversifying revenue streams, and reorganisation in similar ways Peretti describes in his four-point plan. As a case in point, take a look at results thrown up when searching FIPP.com around these keywords:

- Platforms

- Special interest / vertical brands

- Business / Revenue models

- Organisational transformation

This does not make one publisher more right than the other, of course, but points to the common challenges facing all quality content creators, irrespective of whether they’ve been around for decades or a decade.

There is a familiarity in what Peretti writes in his memo. It shows BuzzFeed, other web-native publishers and their “traditional” counterparts are not that far apart as some would like to believe. These quality content creators can do worse than working closer together on solving industry-wide challenges…

Extracts from Peretti’s memorandum

On Facebook and Google

Facebook and Google’s dominance, writes Peretti, who originally scaled BuzzFeed on the back of platforms, “puts high-quality creators at a financial disadvantage, and favours publishers of cheap media: fake news, propaganda and conspiracy theories, quickly re-written stories with sensationalistic spin, shady off-shore content farms, algorithmically generated content, and pirated videos.”

On fixing the relationship between media and tech

“As the big tech platforms struggle with low-quality, objectionable and abusive content, professional content publishers struggle to get paid fairly for their work. There is an easy fix to these related problems: the platforms should reward valuable content.” But at the moment, in the short term the current ecosystem “favours reducing cost and a race to the bottom.” BuzzFeed, in contrast, “is in it for the long term”.

On evolving the revenue model

While there is an encouraging upward trend in revenues from platforms such Netflix, Amazon, Facebook and Google, Peretti writes, there is a need to “build out a multi-revenue model to compliment our advertising business”. This needs to go beyond “hype cycles” promoting one or the other business model for the digital media industry (silver bullets of sorts, e.g. Native advertising! Pivot to video!). “The reality is more complex; there isn’t one perfect model for digital media. The best media companies generate revenue from many sources, tapping a combination of advertising, subscriptions, studio development, brand licensing, and merchandising.

According to Peretti, in 2017 about a quarter of BuzzFeed’s revenue will come from outside its direct sold advertising business. “In 2018 this will grow to one third of our revenue, and to half of our revenue in 2019. Increasingly, we are creating content and brands that generate revenue from many different sources: commerce, advertising, platform revenue, and show development.”

He uses Tasty, BuzzFeed’s food vertical, as an example, of the various ways in which it is diversifying.

On building a portfolio of strong brands

BuzzFeed “are pursuing the Tasty model of success across our business, and will accelerate our work building strong digital brands that connect with people’s actual lives with the creation of BuzzFeed Media Brands” writes Peretti.

“In the past, consumers were loyal to brands – brands created distant, aspirational images and we strived for them. Increasingly, the balance of power has shifted and consumers have more control. Today, brands need to be loyal to consumers. The companies with the strongest brands are the ones providing service to consumers by touching their lives every day.”

Following the “meteoric rise” of Tasty, BuzzFeed is “expanding this model into other core verticals, investing more in building Nifty for home; Goodful for health and wellness; and launching a new beauty and style brand with a mission of helping everyone express their personal style. Tasty was just the start; there is so much more we can do, building brands the modern way, and helping people connect around shared passions.”

On a new organisational structure

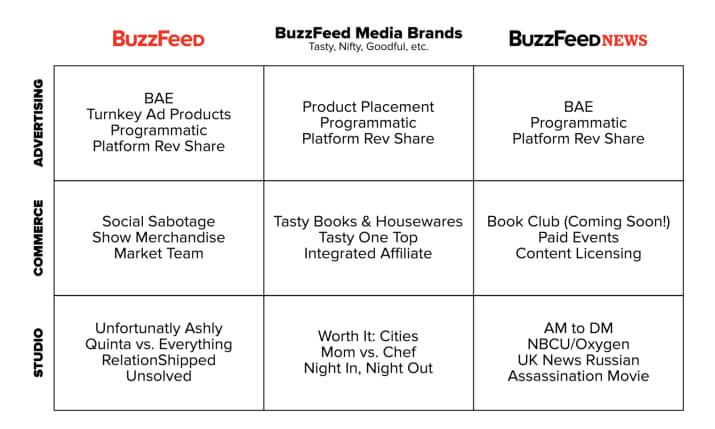

Within the new structure, “each of our core content engines — BuzzFeed and BuzzFeed News, along with Tasty, Nifty, Goodful and a growing portfolio of lifestyle brands in BuzzFeed Media Brands — will grow revenue in each of our core revenue streams: advertising, commerce, and studio development. This will lead to many new opportunities, some of which are highlighted in the diagram below”:

On ‘news of the demise of digital media’ …

Listing successes achieved in 2017, Peretti acknowledges that BuzzFeed did not meet its revenue targets for the year.

“A lot of onlookers want to take that as a sign of the digital media apocalypse, but in truth it’s something a lot simpler (that doesn’t make for as good a headline): we’re growing up. We’ve outgrown the ability to build our business on essentially a single, very distinct revenue stream…”

Peretti’s full memo is here.

More like this

The continued power of special interest media – across all platforms

[Congress speaker Q&A] Four dimensions of successful media organisational change

Publisher business models in the age of platforms

[Congress speaker Q&A] How Ebner Media targets special interest audiences with effective advertising

What is the secret sauce in the enduring power of special interest media?

How Hearst UK repackages content across platforms

Do publishers and platforms really need one another?

Vivian Schiller on what’s next for platforms and the media

A roadmap with ‘six major levers for digital transformation’