Haymarket: Identifying new ways to distribute top-class content

A year ago, Lewis was asked to become brand director for Stuff and What Hi-Fi at Haymarket, while retaining his position as director responsible for Haymarket’s international licensing business. Many people would be forgiven for asking how he could juggle these two demanding roles, seemingly at polar ends of the media domain. Is he trying to juggle two jobs on one beat?

“Frankly I do not see it as juggling two positions. Yes, it can be seen as two jobs and I do have more than one team reporting to me but it actually makes our business much more aligned because my strategy as brand director for Stuff is absolutely aligned with my strategy on how we are growing our international licensing business. The two go hand-in-hand.”

He references the process in which he escalated the business of transitioning Haymarket brands and content from the ‘traditional’ print licensing model to models they could replicate in a digital and mobile environment. From the lessons learnt, they are not only starting to work towards similar goals across the entire business but also towards gaining different types of partners in a multitude of new partnership models.

One example, which he is really excited about, is the model they have developed for distributing and monetising the content of Haymarket’s football magazine FourFourTwo. In a recent deal with Yahoo, the multinational technology giant is paying Haymarket to syndicate FourFourTwo content rather uniquely into their own football news and analyses streams for the US, Canada, and UK markets. Yet, for Latin America and specifically for Brazil, they have struck a more conventional licensing deal allowing Yahoo to have a fully branded FourFourTwo section within the Yahoo portal.

Partnership models

To Lewis, this is not only a huge deal financially but points the way to more possible kinds of partnership models ready to be explored. “Where in the past we may have been working with traditional publishers, we are now also talking to different kinds of companies, which include various types of media owners.”

He explains that even the more ‘traditional’ licensing models are changing. While the Stuff.tv domain, for instance, can be seen as a traditional model with an open-source content management system, international partners can tap into the management system to create their own separate content blend.

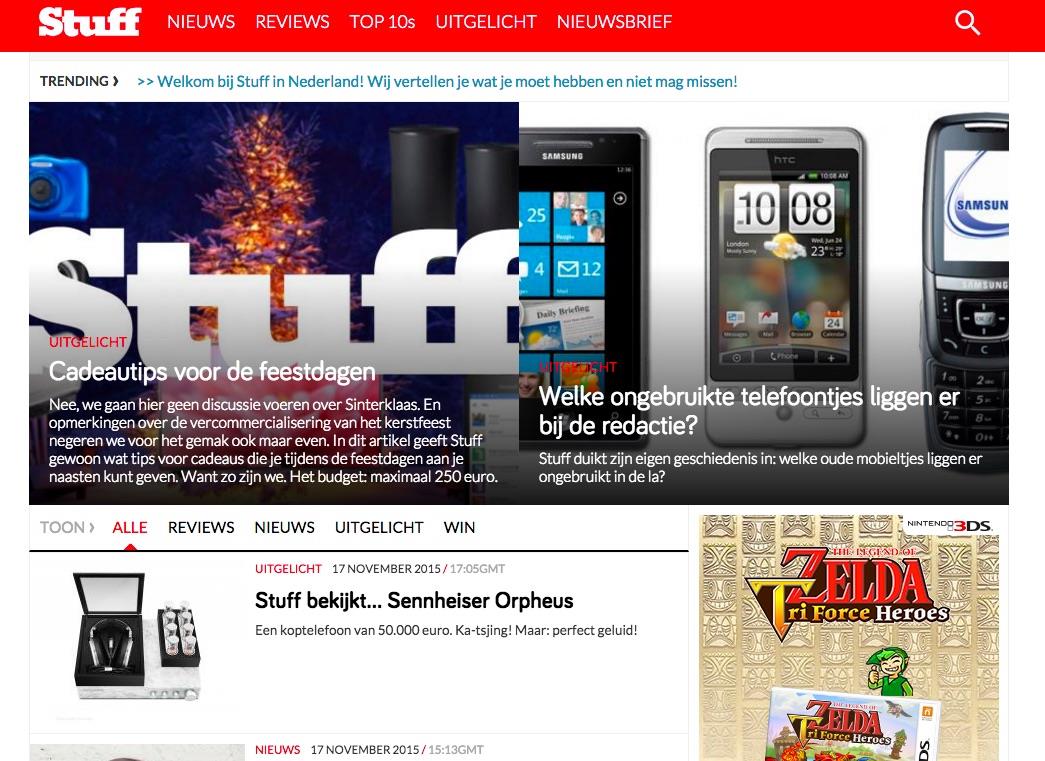

One look at Stuff.TV and this is evident. Nine countries or regions – from the UK to India via the Middle East to South Africa – develop their own ‘channel’ and not one share exactly the same content. “They sit on a single platform and share the same content management system, which makes it possible to share content around the system, however, the editorial and production teams in each local market can decide what they are going to publish and what they are going to produce.” In essence, they are taking global content and producing local content for others to consume.

The reason Lewis describes the example above as “traditional” is because it simulates the model for syndication originally developed for print. “We provide the core assets and the licensing partner will use as much or as little as they want to in their local territory and populate the site themselves.” This is different from the FourFourTwo deal with Yahoo, of which he predicts we will be seeing much more in the future, as well as developing the Stuff.TV model.

Content credibility

Core to any of these diversified future models remains content. “We know that we create world-leading content and that we have got credibility, heritage, and lasting appeal as a result of our brands… Everything we do comes as a result of the investment in and creation of original content. That is the asset that enables us to license, franchise and syndicate to partners – no matter what form the deal takes.”

Above: Stuff.tv Netherlands

Lewis says it has become increasingly difficult to predict where the areas of future global expansion will be. “A couple of years ago I would have said Brazil, Mexico, and Latin America generally because these areas were buoyant but the situation has turned around in the past 12 months. We still have considerable business in those areas, but things are becoming tougher.”

This is countered by increased activity in Asia and more conversations with China, Korea, and Japan, which are all being driven by growth in the way content is being consumed on mobile, which in turn creates a greater need for content. “It means our traditional print deals in the Far East are slowing down, but they are being replaced by some very fascinating concepts and models that we are talking to people about at the moment.”

An example is recent talks with telecoms providers who are developing their own content subscription models for their customers. “They are coming to us, looking to syndicate our content to their users. That is not only interesting but creates opportunities… It comes back to making sure that we have the right APIs and feeds in place that will enable partners and potential partners to use whatever media platforms are going to come to the fore.

“Our job is not to second-guess the future platforms but to open up all our channels to be able to provide that content to whatever platform is needed – taking into account the various speeds of adoption of platforms in different parts of the world.”

More about Alastair Lewis

Lewis joined Haymarket as sales executive-assistant advertising manager in 1999. After being promoted into several advertising management roles across a couple of titles, he took over as Haymarket’s international licensing manager in 2005.

In 2010, Lewis became publisher of Autocar before a promotion to group publisher of Autocar, Autosport and Motorsport News by early 2013, taking on the responsibility of developing Haymarket’s first paid content site – Autosport.com.

In the same year, Lewis became international director and brand director. Since February this year he is both brand director, Stuff and What Hi-Fi? as well as international director, responsible for the growth of Haymarket’s brands in international markets.

More like this

Haymarket’s Stuff drops cover models as research shows they alienate readers

Haymarket reports £11m pre-tax profits

What’s next for Haymarket Media?

Two interesting approaches to content – BuzzFeed’s First Time videos and The RAM Album Club