IAC’s Dotdash to acquire Meredith Corporation’s National Media Group

InterActiveCorp (IAC) has announced that it is to acquire Meredith Corporation, in a US$2.7bn deal. The People magazine publisher will be incorporated into IAC’s Dotdash digital publishing unit, creating a combined company called Dotdash Meredith. Expected to close by the end of the year, the deal will create one of the largest publishers in the US, with leading brands across numerous high value categories including home, health, food, finance, parenting, and beauty.

“The Meredith family is extremely proud of everything the company has achieved over the past 120 years, which is a direct reflection of our dedicated employees,” said Mell Meredith Frazier, Vice Chairman of the Meredith board of directors. “Our creative and devoted employees have guided our beloved brands through a fast-changing media landscape – enriching the lives of generations of Americans. The Meredith Foundation will continue to be an active member in the flourishing Des Moines community, as will Dotdash Meredith.”

Tom Harty, Chairman and CEO of Meredith, added: “Our digital business is growing rapidly, having surpassed our magazine sales for the first time in the company’s history. The combination of Meredith’s celebrated cross platform brands, creative content and first-party data with Dotdash’s digital first brands is a game-changer for the industry. Nowhere else will you find such a premium portfolio of media assets under one roof. We are thrilled to join forces to accelerate Meredith’s digital future.”

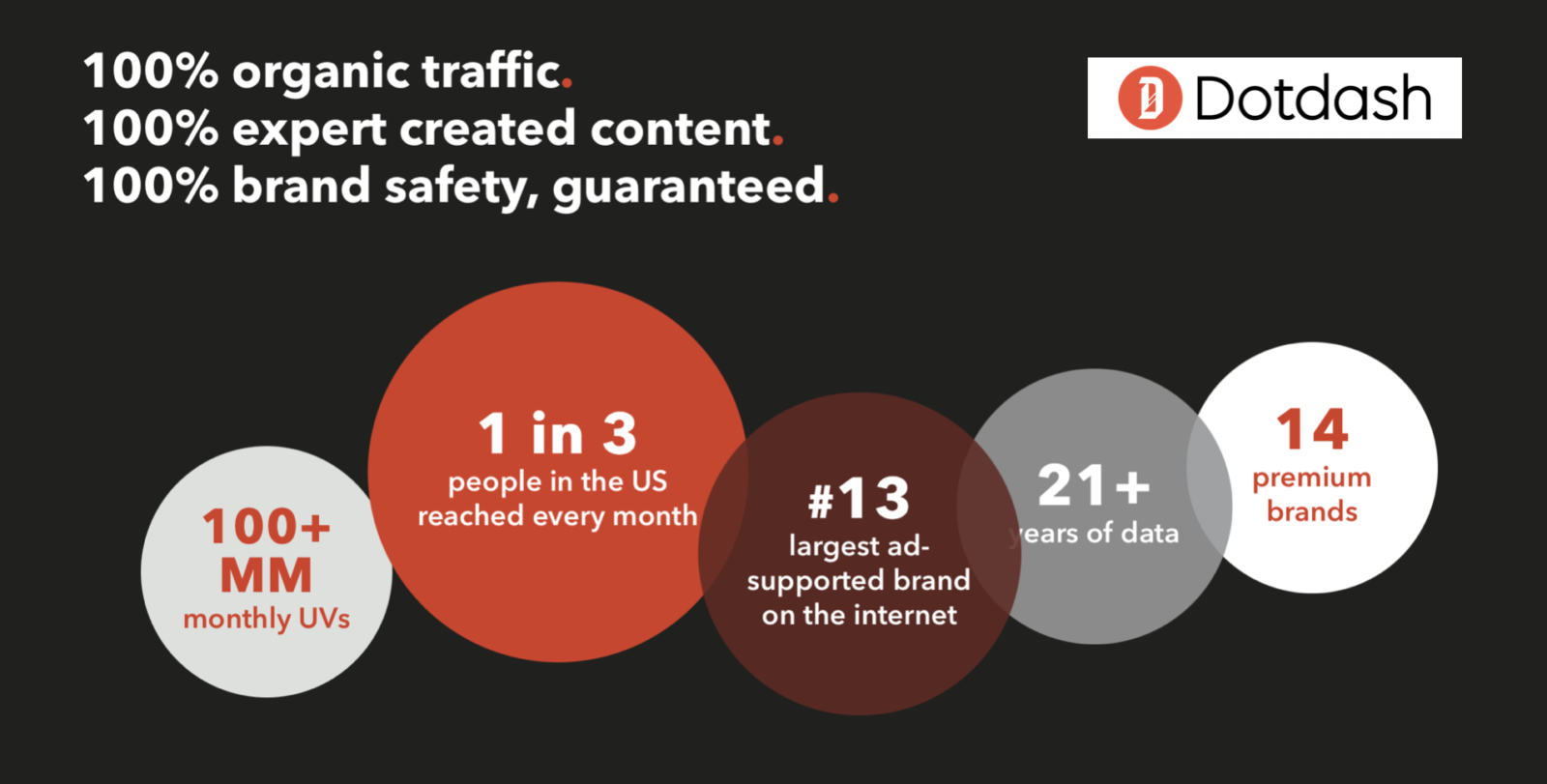

Dotdash itself already reaches approximately 100 million online consumers a month, through a collection of 14 media brands across health, finance and lifestyle, including the likes of Verywell, Investopedia, and The Spruce. The company has seen 17 consecutive quarters of double-digit revenue growth.

With the addition of Meredith’s brands, which along with People include the likes of Better Homes & Gardens, Allrecipes, Southern Living, InStyle and Real Simple, the company says it will enter into comScore’s Top 10, reaching 175 million online consumers monthly, including 95% of US women.

The new company – Dotdash Meredith – will be headed up by current Dotdash Chief Executive, Neil Vogel, who said: “Dotdash is a digital company, and we have a very different prism on how we view publishing. Our success is based on creating the best content and online experiences for each and every topic we cover, without compromise.”

“When we look at Meredith, we see a business that is driven by digital. We see a collection of iconic and venerated brands rich with heritage, leaders in their categories, and similar focus on editorial excellence. We see unprecedented reach to women and a print business that provides longstanding value to readers and advertisers, which we view as a strong platform to reach and engage consumers. The opportunities are limitless. Meredith can step into its digital future and together we can define our next chapter as Dotdash Meredith.”

IAC CEO, Joey Levin, said of the acquisition: “We’ve often found opportunities in the digital transformations of businesses and industries: travel, ticketing, dating, home services, and now publishing. Meredith is already seeing record digital growth and we think Dotdash can help accelerate that. We admire the consumer’s trust in Meredith’s more than 40 brands when it comes to essential life decisions, and we believe true and reliable content created by talented writers, editors, and photographers, backed by real brands, has a very bright future across all platforms.”

“Combined with Dotdash’s ability to deliver readers fresh, unbiased content on any topic, together we can offer uniquely engaged audiences to advertisers and partners—based not on a reliance on private information or personal history but on relevancy to the content they’re consuming and a deep understanding of their needs. No one will do this better than Dotdash Meredith.”

The all-cash transaction translates to a purchase price of $42.18 per share. Meredith’s digital ad revenue has already surpassed its print ad revenue for the last three quarters, and the combined company expects more than 70% of 2021 pro forma Adjusted EBITDA to come from digital. In the last 12 months, the two companies generated advertising revenue of more than $1 billion between them, with e-commerce capabilities that drove more than $1 billion in combined e-commerce sales to retail partners. On a pro forma basis, the combined company expects Adjusted EBITDA from digital assets to exceed $450 million in 2023.

You can find out further details, including investor information, on the IAC website here.