Making a friend of programmatic

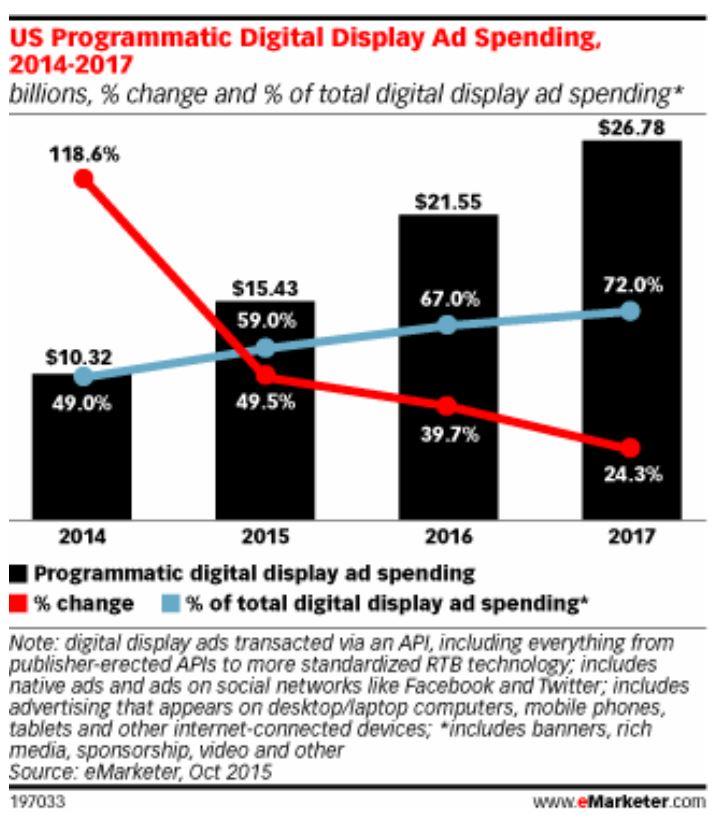

This topic demands our attention because programmatic is a leviathan: automated buying will top US$15bn this year in the US, representing nearly 60 per cent of digital display ad sales. In the UK, programmatic will surpass £2bn in sales next year, and across Europe, programmatic video ad sales alone are on track to top €2bn by the end of this decade, according to eMarketer.

The rise of programmatic is powered by a shared quest by sellers and buyers for speed and efficiency, resulting in higher yields for publishers and higher ROI for advertisers. Both sides remain tantalised by the promise of moving beyond the cumbersome direct-sold model where a sales team deciphers a Request For Proposal and negotiates its way to an agreed Insertion Order, then ad operations manually traffics the deal.

While the motivation remains the same, the definition of programmatic continues to evolve. At the highest level, programmatic is about using technology to automate the selling and/or delivery of digital ads. Up until recently, this mostly meant selling individual ad impressions on a real-time-bidded (RTB) basis in an auction conducted via an advertising exchange. From the beginning, programmatic took on a bargain basement image as RTB was used to clear out the tail of publishers’ remnant inventory at very low prices.

However, the growing trend of Programmatic Guaranteed – where the buyer and seller agree on a certain volume of impressions sold at a specified price, transacted using Deal IDs or in private exchanges – blurs the distinction between direct and programmatic sales. This form, and the rise of programmatic video, show that programmatic is going up-market in both image and reality.

Four flavours

Given the fast pace and complexity of the space, it’s helpful to clearly define the four types of programmatic ad selling available to premium publishers (who often use some or all in combination), and understand the benefit of each to publishers.

- Automated Fixed Price, Reserved – Sales of well-defined, guaranteed inventory are executed directly between a single buyer and seller. The actual ad serving is executed programmatically. Publishers retain full control over buyers and pricing, and once a buy is made, inventory is reserved just as it would be with a manual direct sale. This type of selling can preserve the benefits of direct buying while lowering overhead costs.

- Fixed Price, Unreserved via Deal ID – Deal ID lets you programmatically transact deals at an agreed price with a defined buyer, but on a non-guaranteed basis. These are still technically auctions, but a publisher can set specific pricing and inventory access for every one of their buyers. This type of selling maintains price and inventory controls while meeting buyers’ demand for programmatic access to their inventory.

- Private Exchanges – Like Deal ID, this method relies on a bid protocol and limited participation, but unlike Deal ID, prices are variable and unfixed. Private exchanges could be one or a group of publishers, with restrictions on buyer access and price floors. This type of selling is often seen as a useful layer in between direct-sold inventory and that sold on the open exchange.

- Open Exchanges – This is the original, and still common, type of programmatic selling. Unreserved inventory is sold on a RTB basis in an auction without price floors or limits on buyer access. This method is prized as an easy way to monetise unsold inventory.

Growing pains and opportunities

Five years ago, the programmatic space was driven primarily by buyers gorging on mountains of cheap, programmatically accessible inventory. Gradually, calls for accountability grew. Advertisers demanded to know more about where their ads run, expressing concerns about viewability, bot traffic and audience verification. While progress on each of these concerns has been made, buyers continue to push for improved brand safety through increased transparency and viewability.

Challenges abound. Many publishers have found that even though they gain efficiency with programmatic sales, RTB impressions sell at lower than expected prices, nullifying potential net gains. Publishers with strong name recognition are wary of channel conflict with direct sales, as well as a perceived taint from RTB’s bargain basement, remnant-focused image. Perhaps most critically, publishers have struggled to respond to the increasingly complex technical and strategic challenges of the fast-moving space.

A recent Boston Consulting Group (BCG) report on 25 large international publishers offers recommendations to address key publisher needs.

- Staffing – New technical skills are still needed in publishing (e.g., data scientists and software engineers). The most successful publishers are developing sophisticated analytical capabilities to guide their business and customers. Also, smarter organisational structures must be built to ease multi-platform sales.

- Technology – Publishers need to invest to develop and sustain a clear IT strategy. That could mean choosing one supplier to execute all aspects of automation or having a range of suppliers to perform specific tasks.

- Selling and pricing models – Publishers must more carefully evaluate the four types of programmatic selling described above and choose the model – and pricing approach – that best fits their assets, abilities and strategy. Programmatic prices can be nudged toward direct-sold prices, reducing channel conflict and improving revenue.

Read the BCG report to explore in detail their recommended steps for maximising the potential of programmatic.

It’s clear that programmatic selling will only grow in importance as an engine of digital advertising. Publishers can ensure they’re positioned for success by reassessing their strategy, selling approach, pricing, technology and organisation across both traditional direct and programmatic channels. Those who do will see immediate benefits as they harvest more of the promised benefits of automation and set themselves up to take fuller advantage of the next phase of innovation.

More like this

Condé Nast Digital boosts revenue with programmatic

Over half of all mobile media buys are programmatic

New research reveals 50 per cent of marketers are buying mobile programmatically