IAC Meredith Deal: Background, analysis, and industry reaction

As we reported last week, InterActiveCorp (IAC) is to acquire Meredith Corporation in a US$2.7bn deal. The move sees components from the Nasdaq and NYSE-listed companies merge to form new entity, Dotdash Meredith. Here, we take a look at the background behind the deal, some of its key details, and how the industry has reacted.

Background: An industry reacquiring its dynamism

2021 has been a period of high-level change within the industry. From Ringier’s acquisition of Axel Springer’s businesses in much of Eastern Europe, to the latter’s own purchase of Politico and partnership with Facebook, we’ve seen much commercial movement behind the editorial scenes. This trend was underlined in August, when Future Plc announced that it had acquired Dennis Publishing, in a £300m deal.

Now, with the sale of Meredith, FIPP President & CEO James Hewes, says the pace of change – and emergence of opportunity – is accelerating:

“As predicted, the pace of M&A activity in our industry continues to gather speed and now it includes the biggest name in American magazine media,” says Hewes. “Meredith, with its unparalleled connections to American female audiences, has long been an attractive prize and the prospect of uniting these with its own considerable audience scale will have been a prime motivating factor for IAC.”

“It’s also encouraging to see a large digital business acquiring a company that still has such a large presence in print. These continue to be exciting times for our industry and the wealth of new opportunities presented by this deal will be fascinating.”

Analysis: The deal done, Thy kingdom come

IAC Dotdash

InterActiveCorp (IAC) is a US holding company with a focus on media tech. Initially established in 1986 and now listed on the Nasdaq, its portfolio includes more than 150 brands and companies.

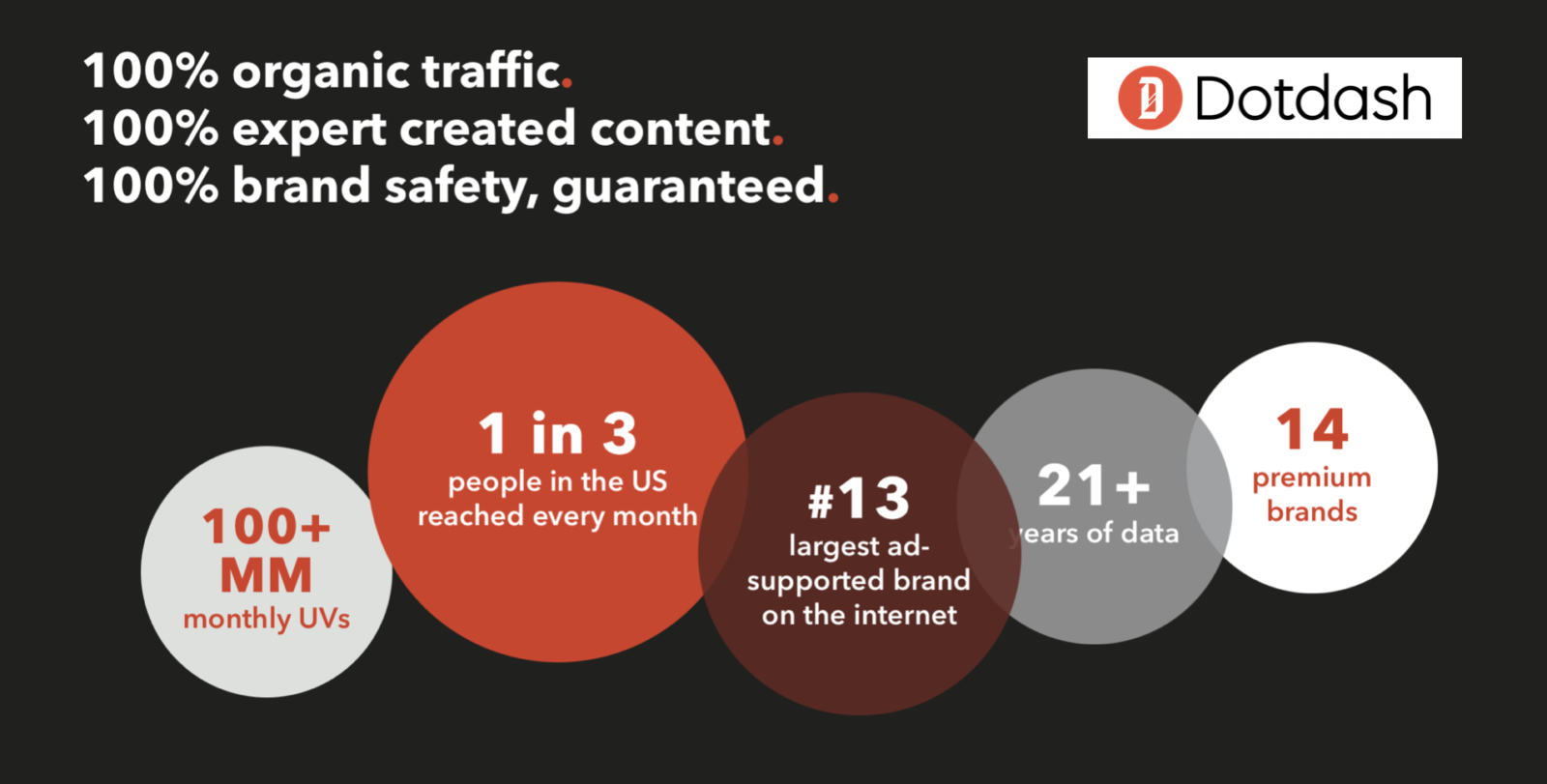

Within this sits Dotdash, a digital media entity with 14 premium brands across finance and lifestyle, including the likes of Verywell, Investopedia, and The Spruce. Prior to the acquisition of Meredith, Dotdash platforms alone accounted for a reach of 100m+ monthly visitors, and the company has experienced 17 consecutive quarters of double-digit revenue growth.

Meredith Corporation

Of course, regular visitors to FIPP.com will likely be more familiar with Meredith, one of our most longstanding members. But it’s worth just taking a brief look the company’s more recent history – and now its immediate future – to better understand how it arrived at where it’s at today:

- November 2017 – September 2018: Meredith bought Time Inc. in November 2017, in a $1.34 billion all-cash deal. It then went onto sell a number of key platforms including the Time media brand to Salesforce.com for $190m in September 2018. We’ve got the full historic timeline on all of those events here.

- May 2021: Fast forward to May of this year and the company announced that it is to sell Local Media Group – its 17 station strong television division – to Gray Television for $2.7 Billion, (coincidentally enough the same fee for which the National Media Group (NMG) side of the business just sold).

- October 7th 2021: Then last Thursday, IAC announced the acquisition of the publisher, and said that it will be incorporated into its Dotdash digital publishing unit, creating a combined company called Dotdash Meredith.

Dotdash Meredith

So what do we know about Dotdash Meredith? Well a few things actually:

- With the addition of Meredith’s brands, which along with People include the likes of Better Homes & Gardens, Allrecipes, Southern Living, InStyle and Real Simple, the company says it will enter into comScore’s list of Top 10 online properties, reaching 175 million online consumers monthly, including 95% of US women.

- It will be headed up by current Dotdash Chief Executive, Neil Vogel, who said: “Dotdash is a digital company, and we have a very different prism on how we view publishing. Our success is based on creating the best content and online experiences for each and every topic we cover, without compromise.”

- It’s also true that Dotdash’s expertise in the digital space are likely to help fuel further growth in Meredith brands, as Tom Harty, Chairman and CEO of Meredith commented at the time of the deal: “Our digital business is growing rapidly, having surpassed our magazine sales for the first time in the company’s history. The combination of Meredith’s celebrated cross platform brands, creative content and first-party data with Dotdash’s digital first brands is a game-changer for the industry. Nowhere else will you find such a premium portfolio of media assets under one roof. We are thrilled to join forces to accelerate Meredith’s digital future.”

- The all-cash transaction translates to a purchase price of $42.18 per share. Meredith’s digital ad revenue has already surpassed its print ad revenue for the last three quarters, and the combined company expects more than 70% of 2021 pro forma Adjusted EBITDA to come from digital.

- In the last 12 months, the two companies generated advertising revenue of more than $1 billion between them, with e-commerce capabilities that drove more than $1 billion in combined e-commerce sales to retail partners.

- On a pro forma basis, the combined company expects Adjusted EBITDA from digital assets to exceed $450 million in 2023.

- The transaction is expected to close by the end of the year, and you can find full details on the IAC website here.

Reaction: Three industry experts and further reading

So with that said, how do those looking on from within the industry view the specifics of the deal? And what can it tell us about the wider magazine media trends going on in the world today?

As former CEO of ACP Magazines, Axel Springer International and EMAP B2B, and now writer of global media weekly, Flashes & Flames, Colin Morrison need not sugar-coat his analysis. And he certainly gave us some candid views in response to the deal, particularly as regards the aspect of the previous Time Inc. deal mentioned above.

“The fact that Meredith has been sold for almost exactly the same net price as three years ago it paid for Time Inc. says all you need to know about one of the worst magazine acquisition deals of the last 30 years.”

“Meredith bought Time Inc. when it (Meredith) had become the most widely admired magazine publisher in the US. Its Better Homes & Gardens was one of the most consistently successful monthly magazines and the company (then as now) has more successfully leveraged its brands through retail product licensing than any other publisher. Meredith had prospered through its skilful management of ‘service’ monthlies across the growth sectors of homes, food and family, while Time Inc.’s major weekly brands were almost uniformly in decline.”

“Everything about the 2018 deal was wrong. Meredith was steadily growing, Time Inc. was shrinking. Meredith was based at low-cost out of town Des Moines, Iowa, and Time Inc. was headquartered in the luxury of Manhattan’s Rockerfeller Plaza. Plus – for all the fame of the Time Inc. brands – some 100% of the total profit came from People magazine (off its best but still very profitable) – and not the kind of brand that Meredith knew anything about.”

“Within a year, Meredith was forced to concede it had under-estimated the weakness of the Time Inc. portfolio and the cultural mismatch of the two businesses. It was, of course, hubris. Accomplished Meredith executives were persuaded to see their acquisition of Time Inc. as a consolidation of their market leadership, effectively a statement about their role as winners over the legendary company that had been magazine aristocracy for almost a century. They couldn’t believe their luck!”

“But the point is that Meredith still has all the business, which was trading so well pre-Time Inc. and now that disastrous acquisition has been written-off, Dotdash can profit hugely from a deal which – apart from all else – gives it three of the best media brands in the US: People, Better Homes & Gardens, and Allrecipes. It’s all up from here.”

Samir “Mr. Magazine™” Husni, PhD, President and CEO of Magazine Consulting & Research Inc., says he was not surprised by the acquisition.

“The only surprise left in this transcended media world we are living in is the lack of the element of surprise itself, said Husni. “Today Dotdash buying Meredith, tomorrow Facebook buying Condé Nast, and the day after tomorrow Twitter buying Hearst. Nothing surprises me anymore. Media companies, regardless of whether they are legacy or not, still recognize the value of the real customers, real readers, and real users who can be documented and counted.”

“Meredith’s database about American women made it a particularly attractive acquisition. This is real data that no other media company has or can compare to. You can rest assured that Dotdash will invest heavily in harvesting that data and taking it to a much higher level than Meredith has done so far.”

So does Husni feel that – despite the new company being dual branded – this could eventually lead to the disappearance of the Meredith brand altogether (a question I felt was a bold one at the time of asking!)

“Anyone remember Time Inc.? The beauty of magazine media companies is that their audiences remember the brands and not the mother company. Most of the audience is not aware of Meredith, but rather of People magazine, or Better Homes & Gardens, and so on. It is only the folks in the media circles who link the individual brands to the mothership company. So, yes feel free and courageous to dare and ask if at some point the name Meredith will disappear one day. Think CBS magazines, Fawcett magazines, HFM, etc…”

“I am very bullish about the future of our magazine media industry. All the new or newly created digital media companies will not buy the legacy media if they don’t see the value in them… they are not buying those legacy brands for anyone’s or anybody’s sake, but rather for the value that they will bring to the bottom line. At the end of the day magazine media is a business and like any other business the ultimate goal is to make money, full stop and end of discussion.

“The timetable has started ticking and the ultimate watch will be how fast or slow Dotdash will make its plans for Meredith public… keep in mind, almost with no exception, every media merger or acquisition starts with “nothing is going to change, we will stay the course….”

Finally, we spoke to industry veteran and President & Publisher of Precision Media Group, Bo Sacks, to get his thoughts on the deal:

“Media deals large and small are historically part of our DNA as in any other sector. Meredith buys Time Inc. for $2.8 billion which then divests Time Magazine for $190 million, Sports Illustrated for $110 million, and Fortune for $150 million. And then Dotdash buy Meredith for 2.7 billion. It’s the natural order of things.

“Dotdash and Meredith combined become the 10th-largest Internet property in terms of unique visitors in the US I believe the hope is to achieve greater visibility and attractiveness to advertisers. They do this with the power of some of the most renowned branded titles on the planet.”

“As Meredith did in the Time Inc. deal, Dotdash may prune the portfolio, but I would add that Dotdash has successfully managed 14 disparate brands with content meant to cleverly drive e-commerce for brands in each category. Why not the same with the famous Meredith titles and properties?”

In looking at Meredith’s future, he reiterated Samir Husni’s view that it is the magazine brands, rather than the companies that own them, that resonate in the minds of those outside the industry.

“Will the Meredith name stay or be dissolved into history? I don’t think a majority of the public knows who the publisher of Better Homes and Gardens or Allrecipies is. They love the titles, not necessarily the publisher. Reader’s Digest is a great example of dropping or changing the publisher’s name. The publisher of Reader’s Digest is now called Trusted Media which has multiple titles like Reader’s Digest, Family Handyman and Taste of Home. It’s not the name of any company but the magic it performs that counts.”

“There is nothing negative to be gleaned about mergers or acquisitions. On the contrary it is quite healthy. It is more of a validation that in a digital age some of these trusted legacy magazine brands are what people are looking to now in order to grow their reach/engagement online. The biggest currency any company can have is trust. With trust comes effective commerce. Meredith brands are overloaded with consumer trust and confidence.”

“The nature of media and business models has continued to change and evolve. Magazine-related media, and especially print, is not viewed as a growth area in any sector except for those in the magazine industry. A paradox.”

Further reading

As you might imagine with a deal of this magnitude, the media headlines have been awash with wider industry reaction and I won’t list them all here. But one particularly strong piece of analysis comes from The Wall Street Journal’s (WSJ) Laura Landry Forman, who includes a chart supporting the new company’s claim to have entered into the Top 10 US internet properties, and also says this about Dotdash’s digital approach:

“With Dotdash, IAC has long been confident in its differentiated approach to digital media. Instead of pop-up ads, its 14 brands favor content meant to more organically drive purchases for brands such as lists of best products in a category. Not only do these types of ads enable webpages to load quickly and look clean but they are also less assaulting for the reader. Still, they offer high conversion rates because readers are usually there with some level of intent. You probably aren’t perusing a story on the best gardening hoses or bridesmaid dresses, for example, if you aren’t in the market for either of those things.”

The Dotdash Meredith deal is representative of the fact that it is – as FIPP President and CEO, James Hewes, states – an exciting time for an industry that is now clearly entering into a new round of transition. And as always we’ll keep you posted with the latest and greatest here on FIPP.com!